Market Update April 2023

Banking analysts and economists are starting to cry recession again, as the Fed is faced with a longer road than anticipated to lower inflation. Over the past year, the Fed has raised its benchmark rate by 4.5% and shrunk its balance sheet by over $600 billion. At a minimum, we expect the Fed to raise its target interest rates to 5.25% by the end of the year, which will only happen if they continue to raise rates by 0.25% over the next three quarters. There is a very real chance that rates will move higher than 5.25% because the Fed has such limited tools to combat inflation. The economy is still in the early days of disinflation — a temporary slowing of the pace of price inflation — and the Fed has indicated that they’ll keep rates high until inflation is under control. This uncertainty around interest rates has hit the housing market especially hard.

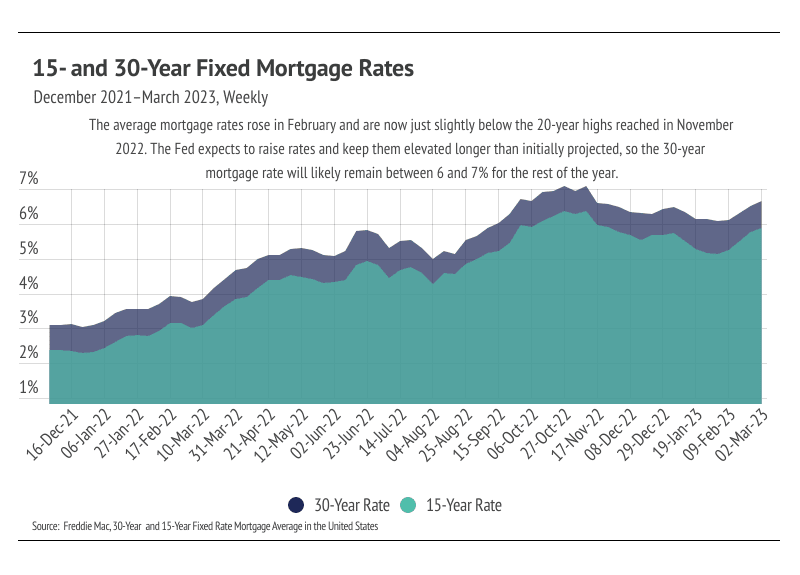

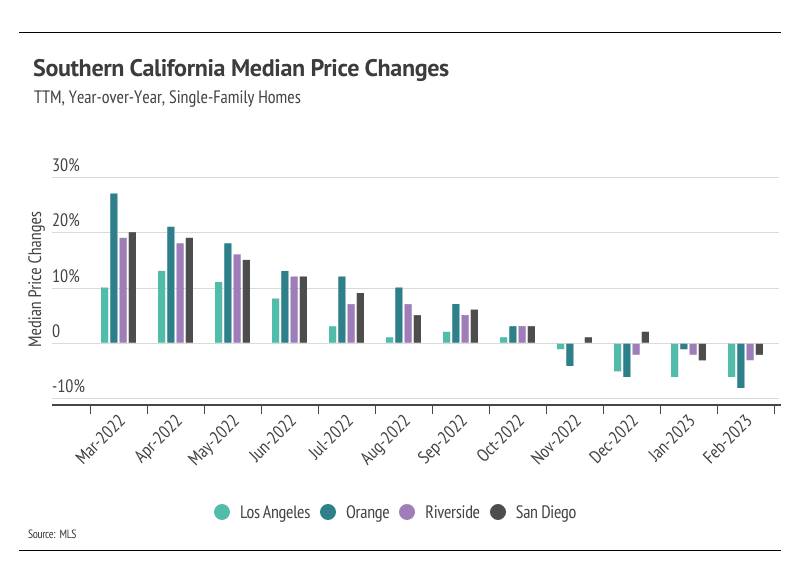

Mortgage rates have been volatile, making it more challenging for buyers in terms of financing and affordability. Historically, the spread between the 10-year U.S. Treasury Securities and 30-year mortgage rates has been around 1.8%. Currently, 10-year treasuries are yielding 4.08%, while the average 30-year mortgage rate is 6.65%, a spread of 2.57%. Buyers and sellers are still getting used to the dramatic mortgage rate hikes that started in early 2021. Even looking back one year, the price difference is substantial. When we account for the 5% year-over-year increase in median price per square foot of a home in the United States, plus interest rates rising over 2.5%, the monthly cost to finance a home rose by 41%. Looking back two years, the monthly cost has risen by 81%.

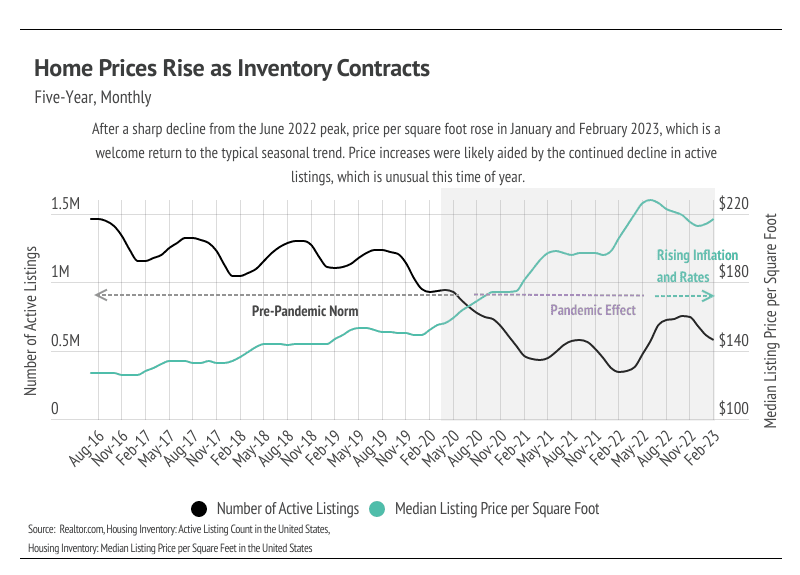

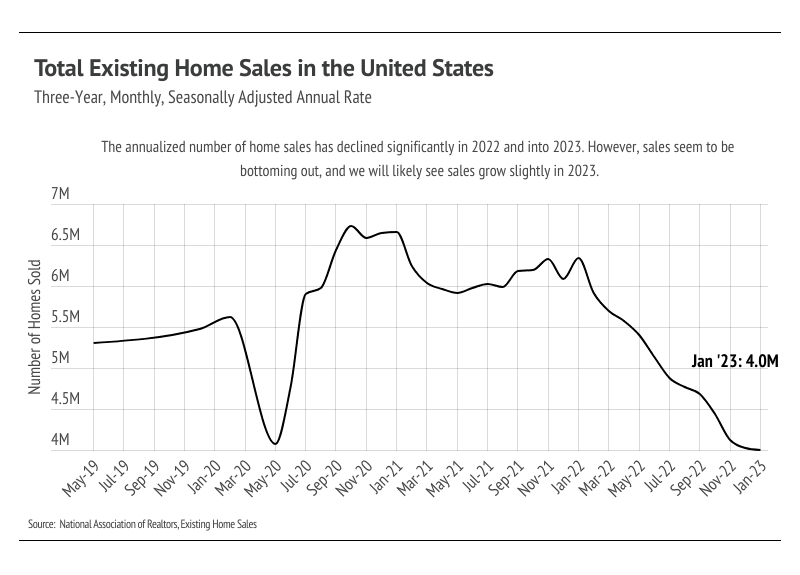

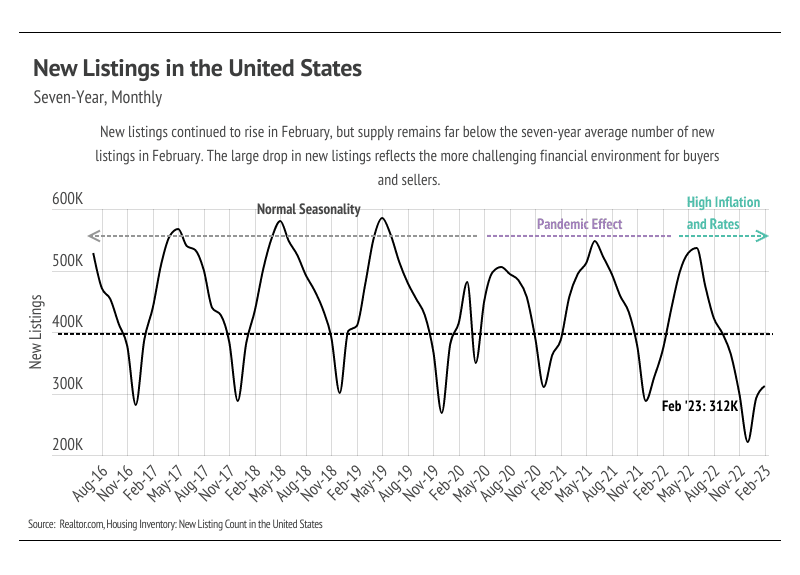

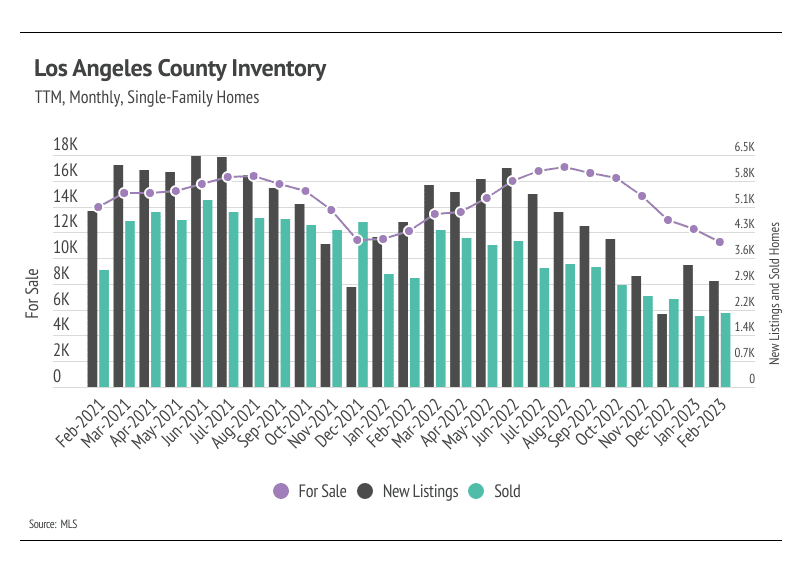

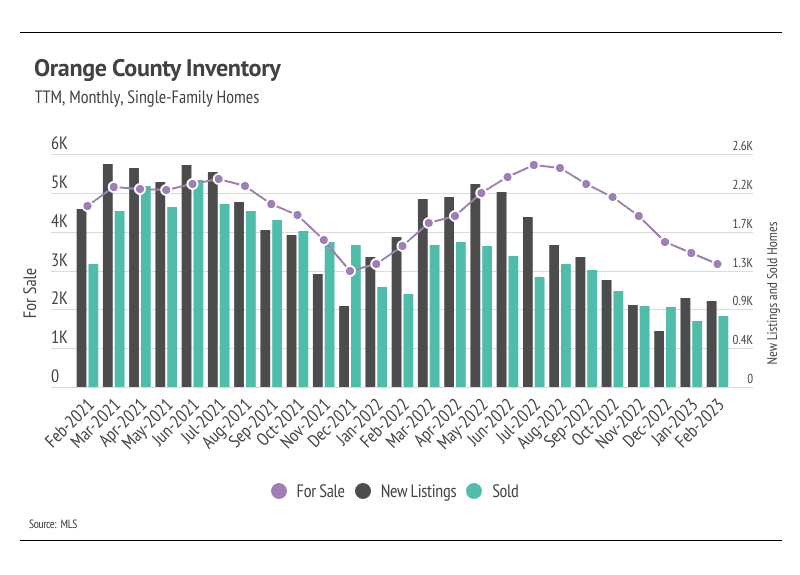

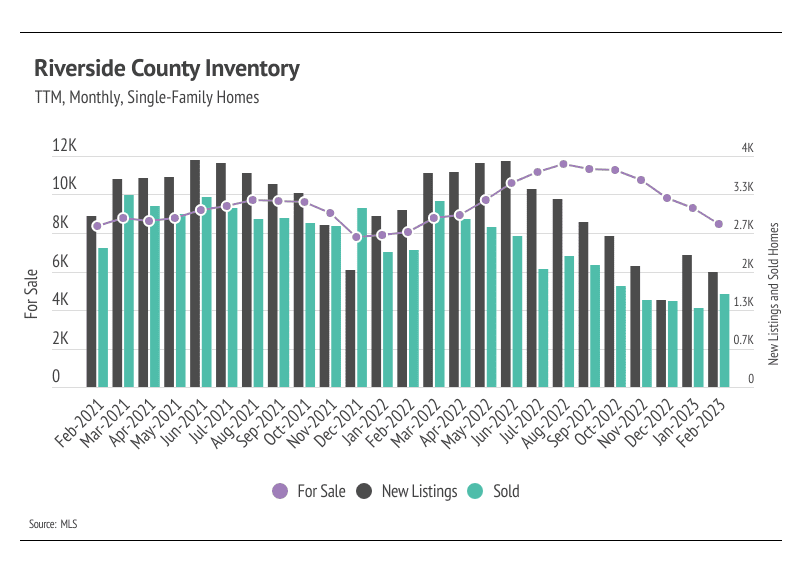

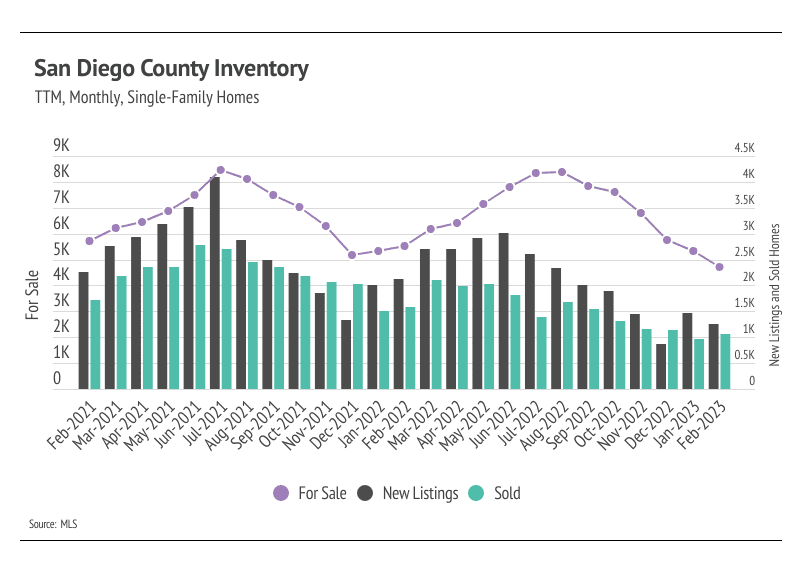

The housing market has done what you’d expect of any market when cost rises so rapidly: It slowed down substantially. The number of home sales in 2022 was exceptionally low, and we expect sales to remain low in 2023, since mortgage rates will likely stay between 6 and 7% on average for the rest of the year. Additionally, the number of active listings remains historically low but isn’t as large of a concern as it was in 2020 and 2021 due to the large drop in demand.

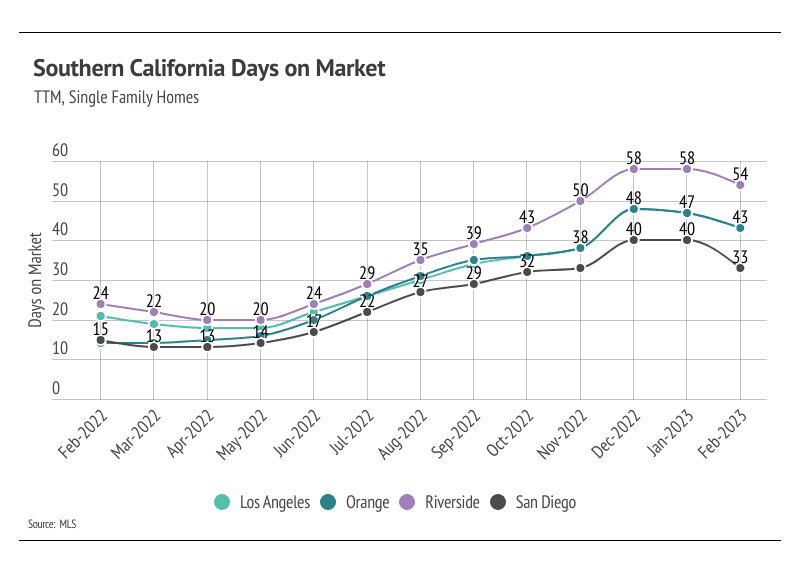

We do want to be clear that the housing market isn’t in a recession, nor is the rest of the country. Still, potential homebuyers, and consumers overall, have far less buying power than they did in the very recent past. The broad economy is still expanding, the unemployment rate is at a 53-year low, and wage growth has been substantial, making a full recession unlikely in the near future. Homebuyers can expect a less competitive market but must continue to be decisive, as desirable homes are still selling quickly.

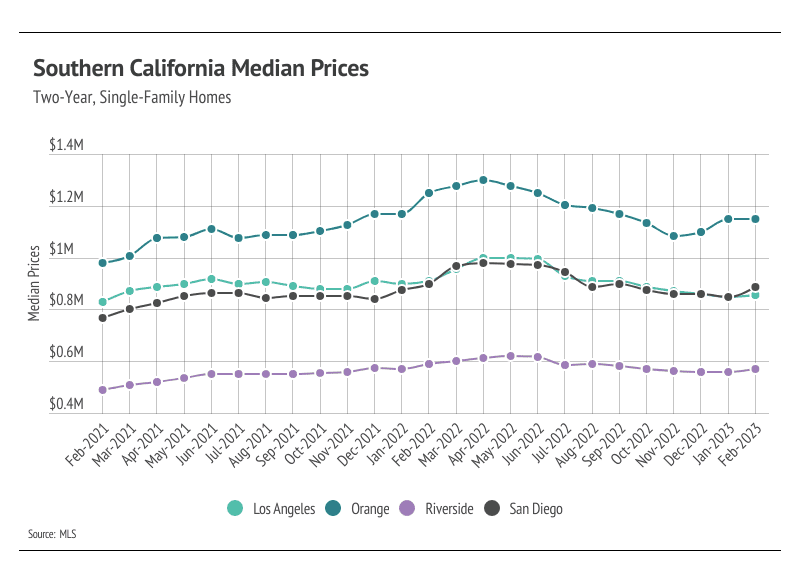

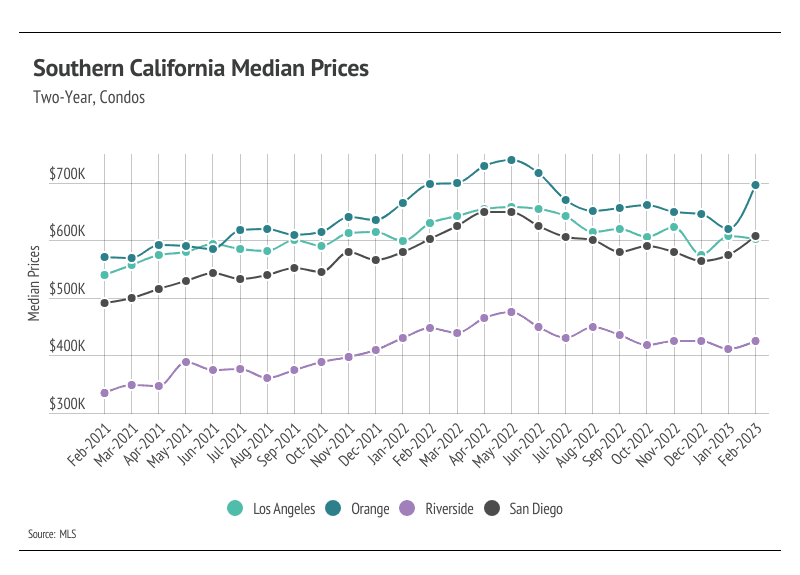

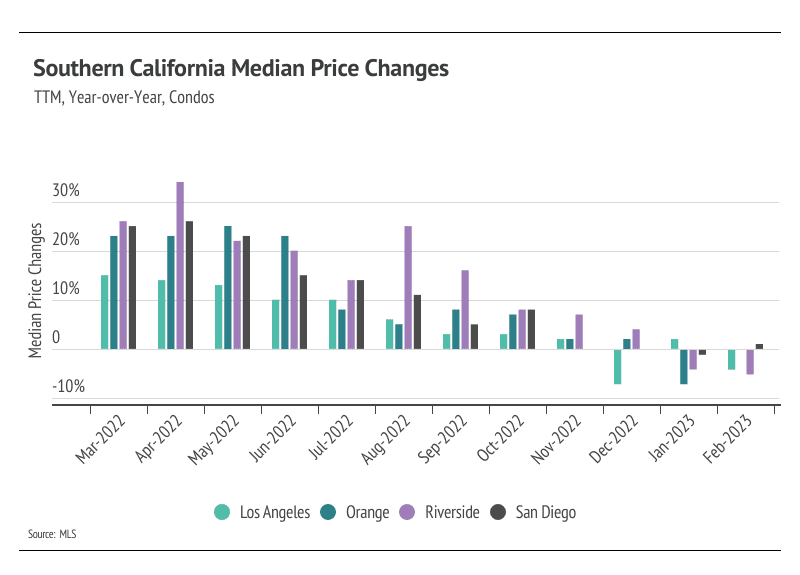

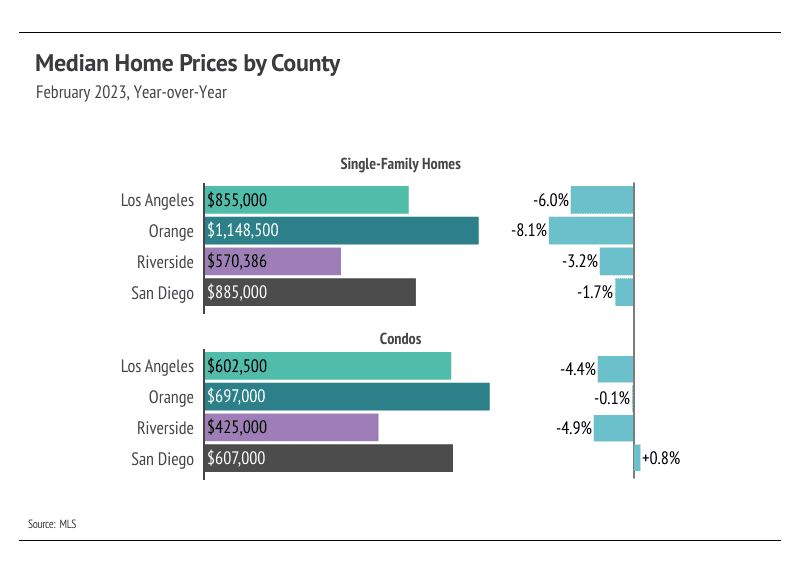

Different regions and individual houses vary from the broad national trends, so we’ve included a Local Lowdown below to provide you with in-depth coverage of your area. In general, higher-priced regions have been hit harder by mortgage rate hikes than less expensive markets due to the absolute dollar cost of the rate hikes. As always, we will continue to monitor the housing and economic markets to best guide you in buying or selling your home.

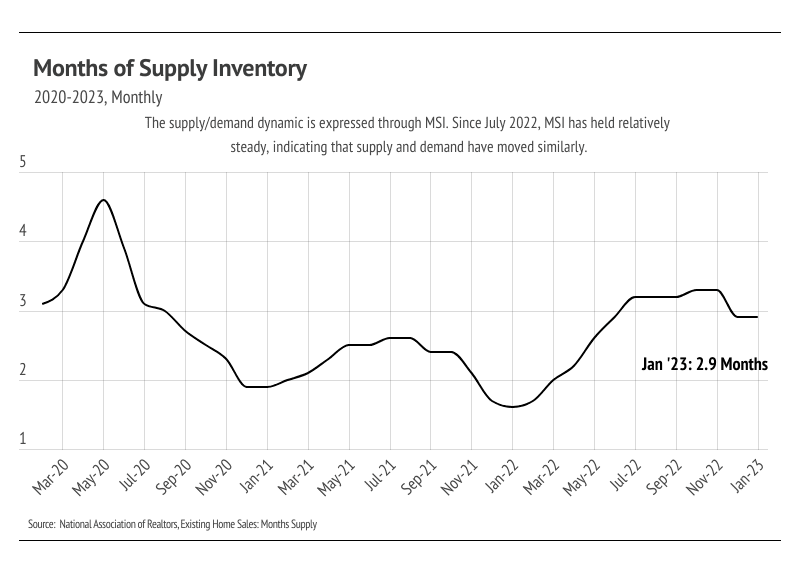

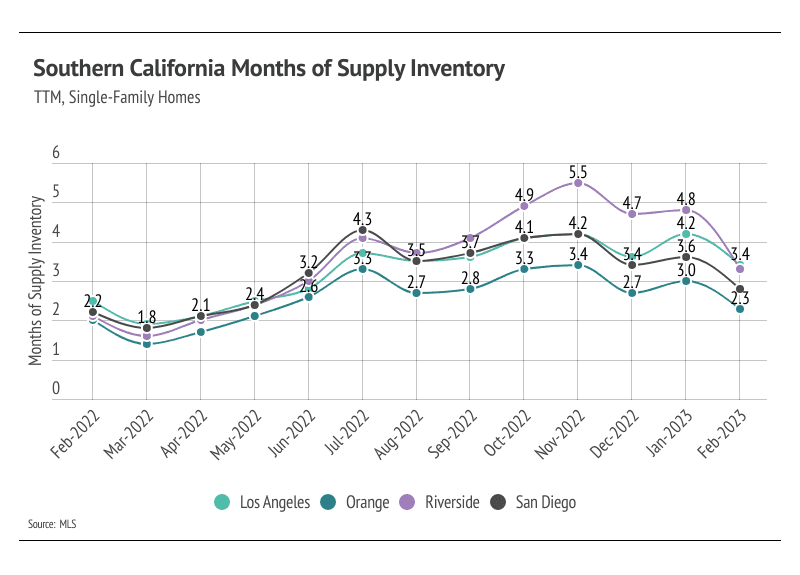

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). MSI dropped in February, indicating that the Los Angeles and Riverside markets moved from buyers’ to balanced markets, and the Orange and San Diego markets moved from balanced to sellers’ markets. The sharp drop in MSI occurred due to homes selling more quickly and fewer new listings coming to market.

Stay up to date on the latest real estate trends.

March 2026

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

You’ve got questions and we can’t wait to answer them.