Market Update Los Angeles

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

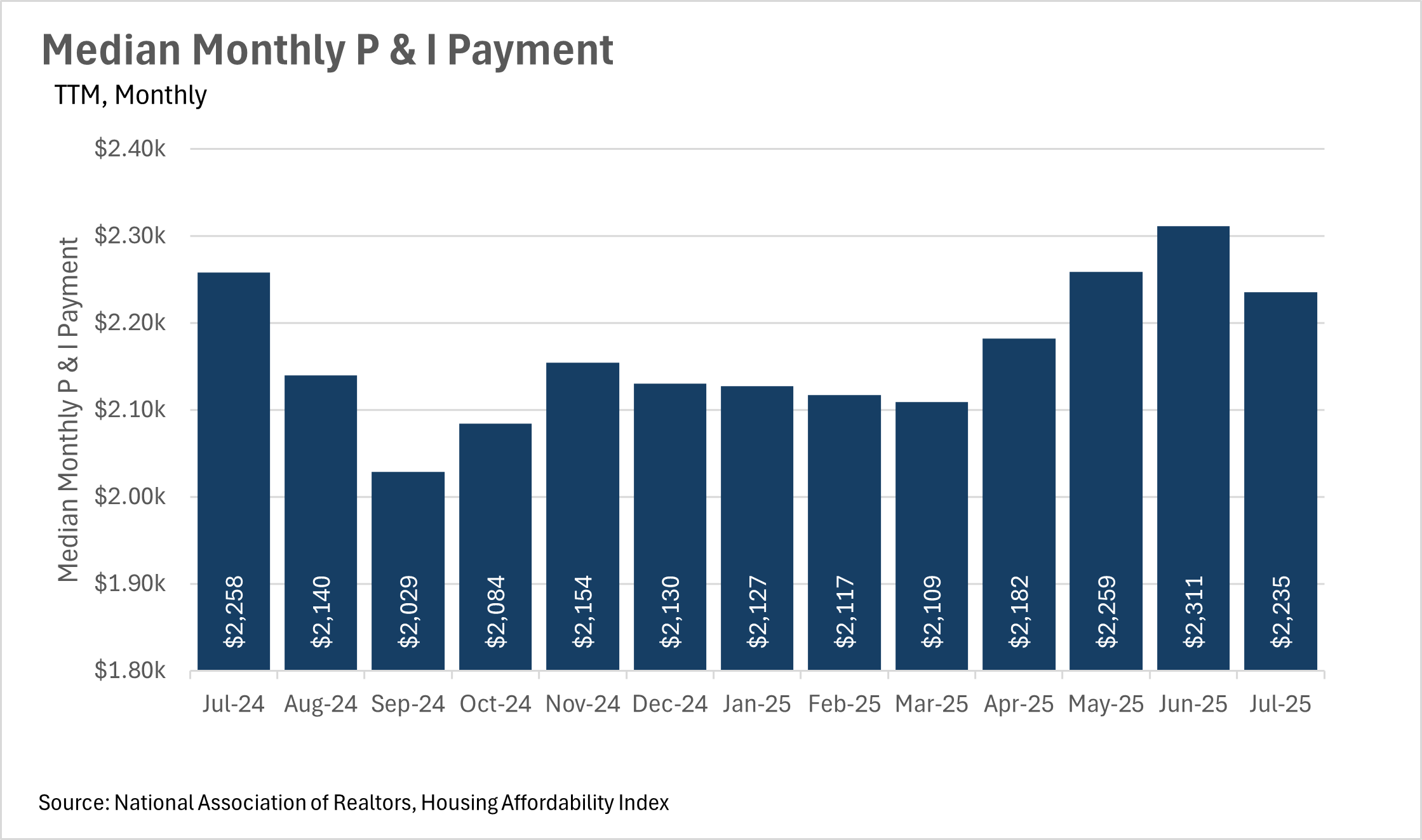

At $2,235 per month in principal and interest payments for the median homeowner, housing costs are near the highest points we’ve seen in the last year. As we all know, this is driven primarily by the fact that interest rates have remained high for quite some time, and home prices have not fallen by much over the past few years. However, existing homeowners might be able to save some money in the coming years/months, as Federal Reserve Chairman Jerome Powell mentioned in his speech at Jackson Hole that the Fed is keen on cutting rates in the near term. This, of course, would translate into lower P&I payments for new and existing homeowners alike.

Last week, the Federal Reserve lowered the federal funds rate by a quarter point — its first cut since December 2024. While the move was widely expected, it officially signals the beginning of what many anticipate will be a rate-cutting cycle over the coming months. For a housing market that’s been largely stagnant, this is welcome news.

For prospective buyers, this shift could create a window of opportunity. If real estate values react the way they did during the last period of significant rate cuts, prices could rise again as demand strengthens. That means buyers who act sooner may be able to secure a home before competition increases — and potentially refinance later if rates fall further.

Following the Fed’s decision, mortgage rates fell again this week. The average 30-year fixed mortgage rate now sits at 6.26%, down from 6.35% last week and the lowest level in nearly a year, according to Freddie Mac. Refinance activity has already surged, with nearly 60% of applications now tied to refinancing.

Looking ahead, economists expect the Fed to deliver at least two more quarter-point cuts before year-end. If that happens, we could see mortgage rates dip closer to the 6% mark — a level that would meaningfully improve affordability for buyers. As always, the Fed will weigh inflation and employment data in its decisions, so those remain the key indicators to watch.

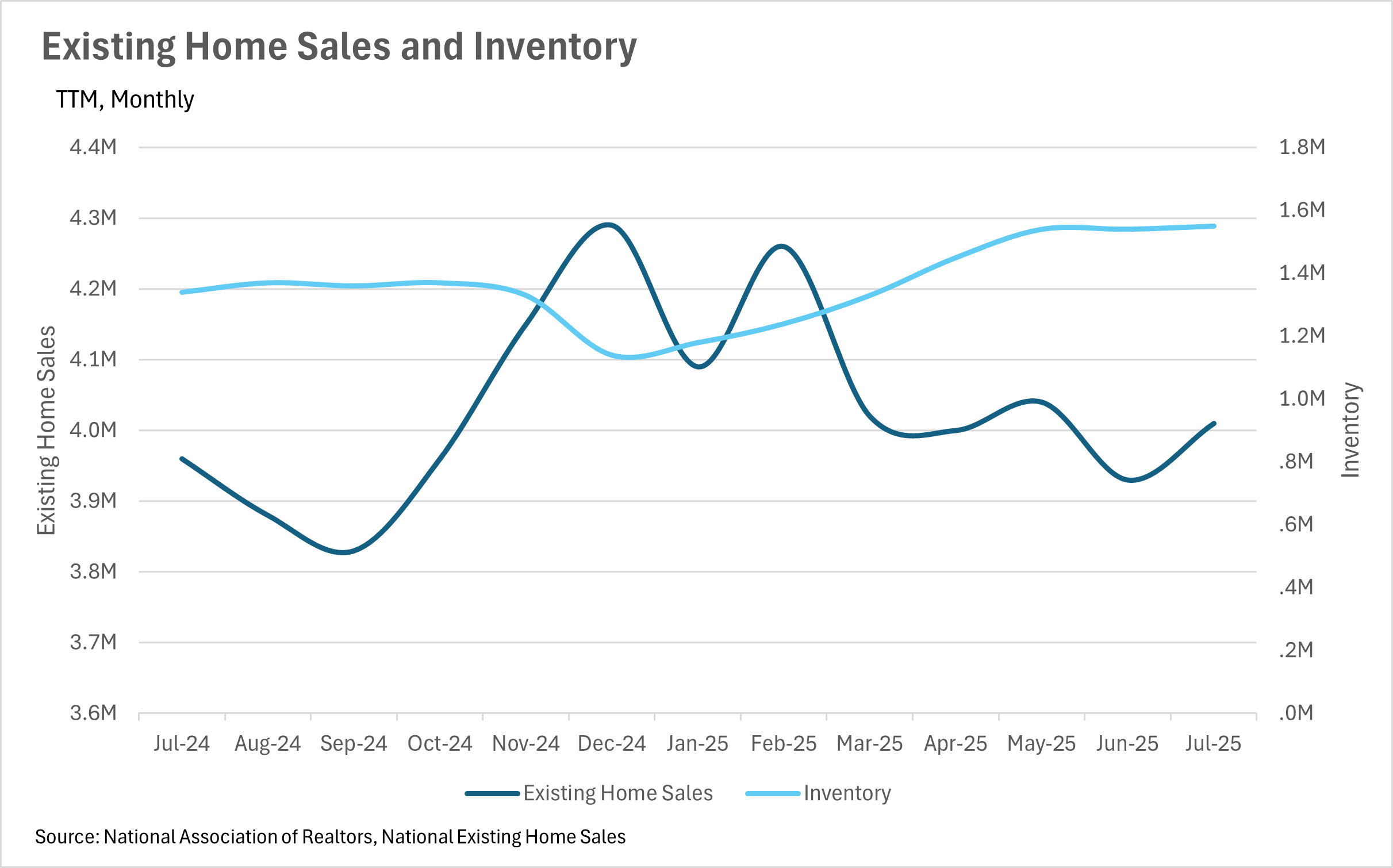

Over the course of the past few months, we’ve seen inventories remain at an elevated level on a year-over-year basis. However, with the recent drop in interest rates and the prospect of lower interest rates in the near-term future, we might see some of the built-up inventory begin to move, as housing becomes more affordable. Over the coming months, it’ll be important to pay attention to inventory levels, as they’re often leading indicators of price movements over time!

It’s important to note, though, that all of this is just what we’re seeing at a national level. To learn more about your local market, be sure to check out the Local Lowdown below:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

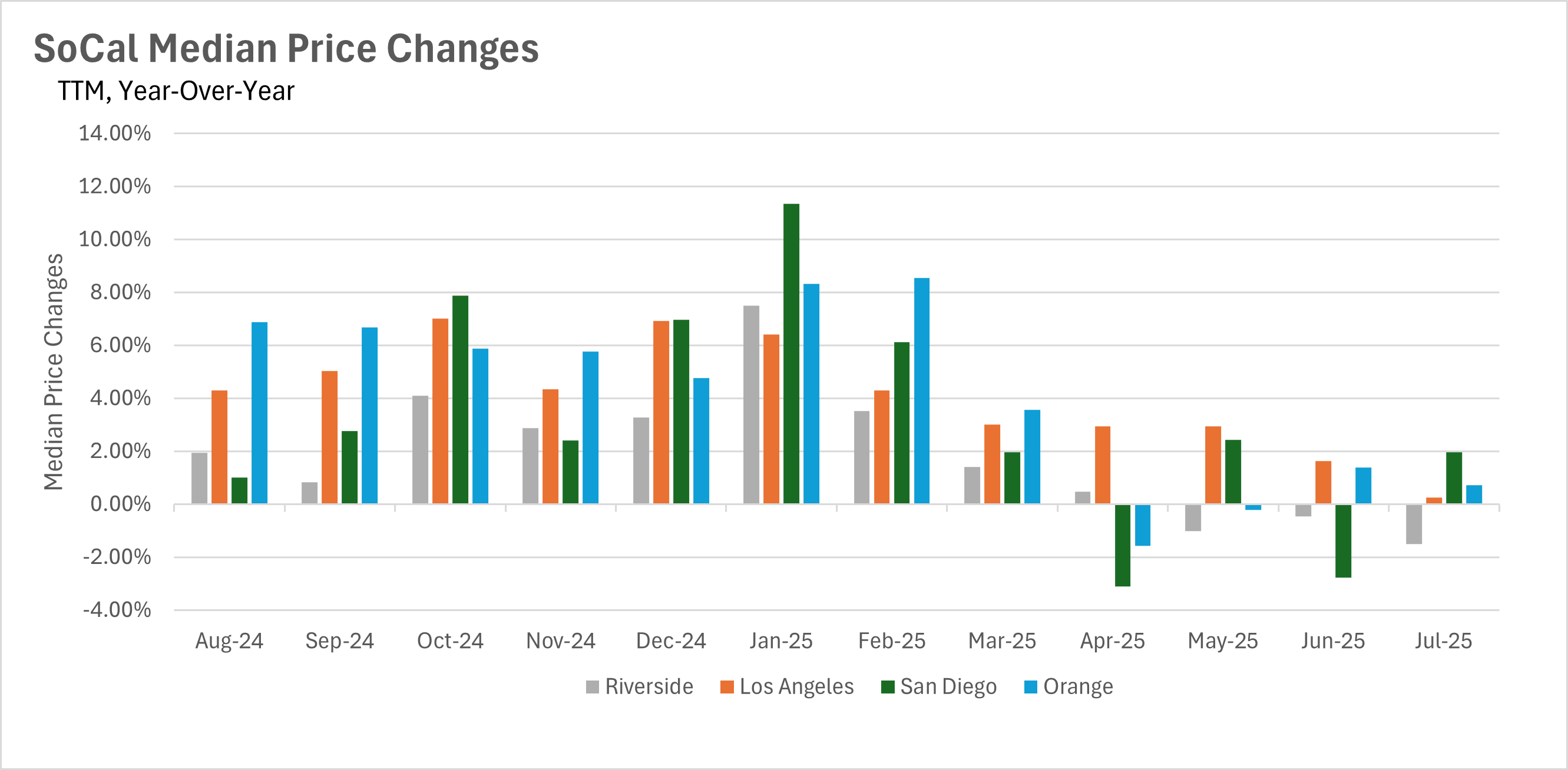

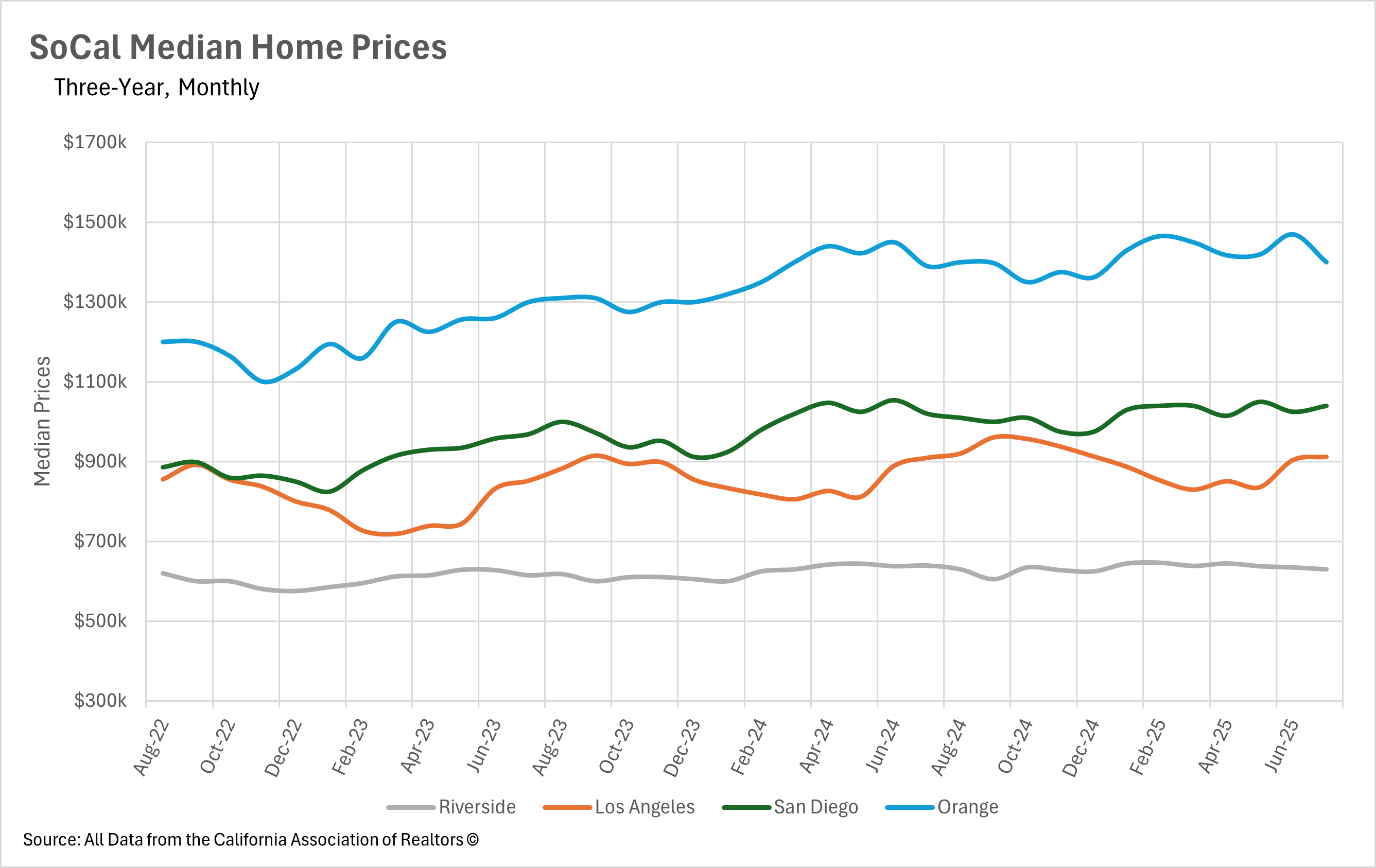

Southern California's real estate markets have reached a dramatic inflection point, with price growth slowing to the lowest levels in recent memory across all major counties. Los Angeles County has experienced the most significant deceleration, with July median prices of $911,360 representing just 0.26% year-over-year appreciation, effectively ending meaningful price growth in the market. This represents a stunning reversal from the 6.41% growth seen in January, demonstrating how quickly conditions can shift when inventory surges. Orange County shows modest resilience with 0.72% annual growth to $1,400,000 in July, though this masks a significant 4.76% month-over-month decline from June's peak. San Diego continues to experience volatility, with June prices declining 2.77% year-over-year to $1,025,000 after earlier explosive growth. Riverside County shows the most sustained weakness with a -1.51% decline in July to $630,000. This widespread deceleration reflects markets reaching equilibrium between substantial available inventory and buyer demand, suggesting future price movements will be more modest and closely tied to broader economic conditions rather than supply constraints.

After months of relentless increases, Southern California inventory levels are beginning to show the first signs of stabilization, though they remain at historically elevated levels. Los Angeles County saw just a 0.26% month-over-month increase to 15,258 listings in August, a dramatic slowdown from earlier months, though still representing a substantial 34.47% year-over-year increase. Orange County experienced its first monthly decline in quite some time, with August inventory dropping 0.71% to 4,917 homes, though maintaining a significant 40.61% annual increase. Riverside County also showed signs of stabilization with a 1.40% month-over-month decline to 7,323 homes in August, while still up 46.96% year-over-year. San Diego continues to show growth but at a more moderate pace. This inventory plateau, coming after months of dramatic increases throughout 2025, suggests that either fewer sellers are entering the market or absorption rates are beginning to match new supply. The stabilization indicates that markets may be approaching peak inventory levels and transitioning toward a new equilibrium between supply and demand.

The sustained high inventory levels continue to take an increasingly visible toll on market timing across Southern California, with properties spending significantly longer on the market than in previous years. Orange County has experienced the most pronounced deterioration, with homes now spending 28 days on market, a substantial 40% increase from July 2024's 20 days and a 7.69% month-over-month increase from June. Los Angeles County shows homes taking 27 days to sell, representing a 42.11% year-over-year increase and a 12.50% monthly increase from June's 24 days. San Diego properties spend 21 days on market, up 50% from last year, while Riverside homes take 40 days, a 26.67% annual increase. This deterioration in market timing, even as inventory growth has slowed, demonstrates the lasting impact of the inventory surge on seller expectations and buyer behavior. The extended timelines reflect buyers leveraging their improved position to be increasingly selective and methodical in their purchase decisions, creating a new normal where thorough due diligence and extended negotiations have replaced the rapid-fire market conditions of previous years.

The most significant development in Southern California real estate is the movement toward more balanced market conditions, with several counties showing signs of transitioning from strong buyer's markets toward equilibrium. Los Angeles County has made the most notable progress, with months of supply declining to 3.7 in July from June's 4.0, representing a 7.50% monthly improvement and movement closer to the balanced 3-month threshold. This shift, combined with stabilizing inventory levels and modest price appreciation, suggests Los Angeles may be finding its new equilibrium. Orange County maintains buyer's market conditions at 3.3 months of supply, showing slight moderation from June's 3.4 months but still providing purchasers with significant leverage. San Diego operates in balanced territory at 3.5 months, having pulled back from June's 3.6 months, indicating successful transition from seller-dominated conditions to a more equitable environment. Riverside continues in buyer's market territory at 4.2 months of supply. This regional movement toward balance, after the dramatic shifts of 2025, indicates that markets may be stabilizing after finding new equilibrium points between buyer demand and the substantial available inventory, creating more predictable conditions for both buyers and sellers moving forward.

Stay up to date on the latest real estate trends.

March 2026

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

You’ve got questions and we can’t wait to answer them.