Market Update Los Angeles

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

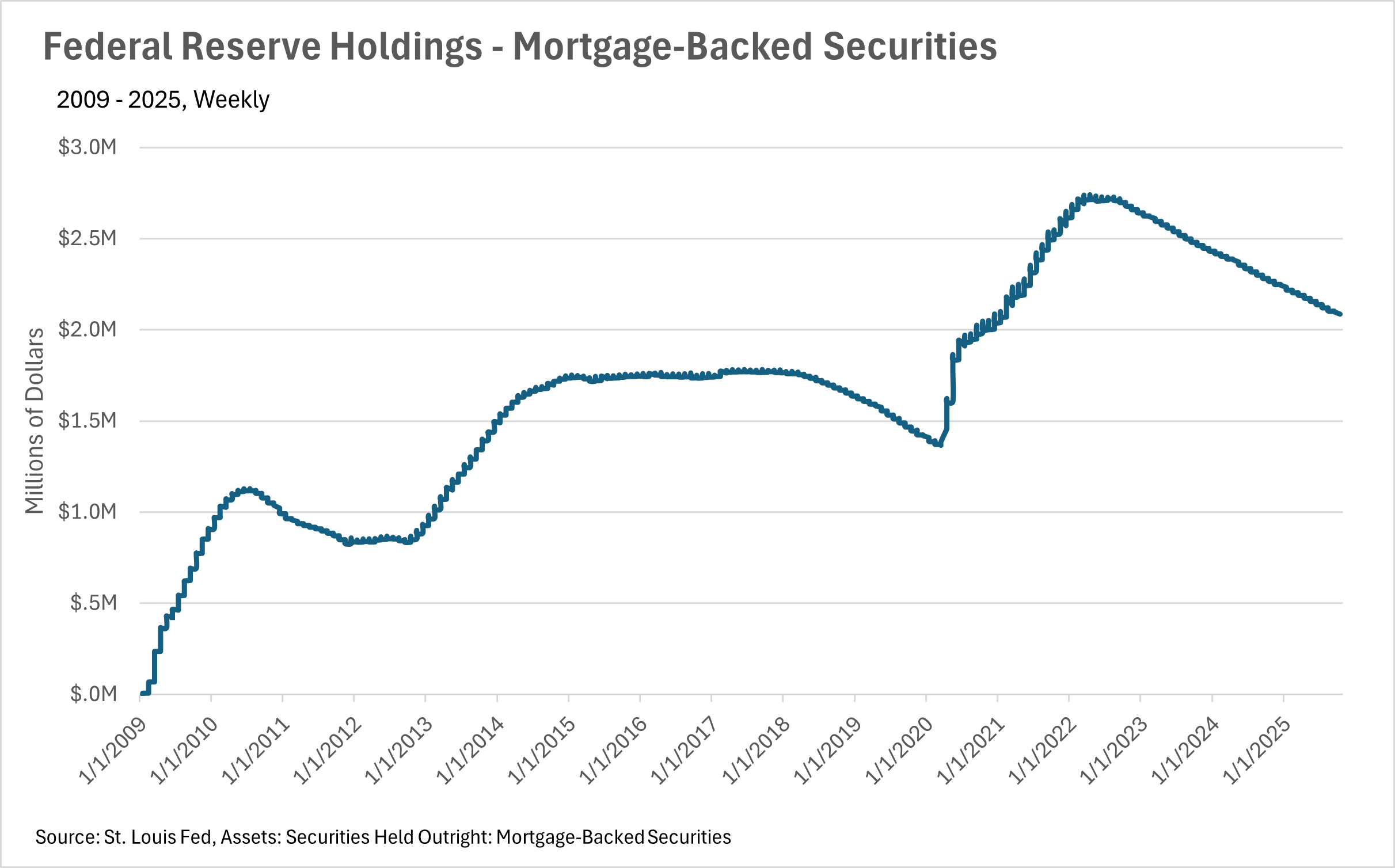

Recently, the Fed came out and announced a quarter-point cut to the federal funds rate, but that was not the most exciting news that they announced. Fed Chairman Jerome Powell announced that we should expect two more quarter-point cuts before the end of the year, signalling that we are in the beginning innings of a Fed cutting cycle. This, of course, is huge news for the housing market. Despite the fact that many markets have retained much of their post-pandemic gains in value, the housing market has been largely stagnant, with inventories building as home buyers decide to sit on the sidelines and wait.

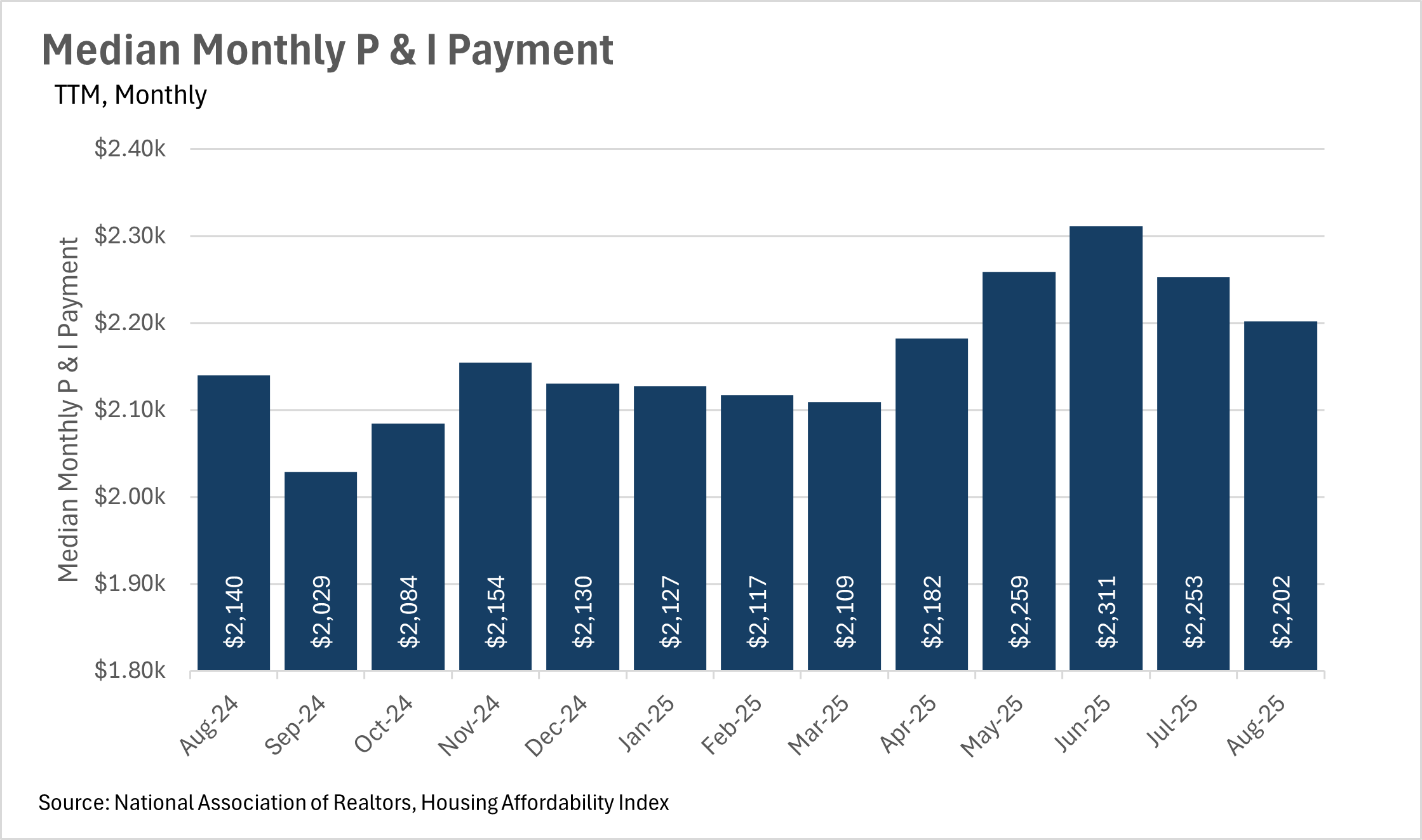

Housing affordability has been a huge problem facing the country ever since the onset of the COVID-19 pandemic. Although many thought that home prices would decrease as interest rates increased, many markets did not see a normalization of home prices. This, of course, has left many prospective home buyers worried about where the market will go as we enter a new rate-cutting cycle. Many fear that lower interest rates may bring a slew of new buyers to the market, pushing home prices up even further, and making home ownership even less attainable for first-time buyers. On the flip side, homeowners stand to benefit in a huge way if declining interest rates lead to a housing frenzy, as they’ll accumulate significant equity in a very small period of time, just like what we saw throughout 2020-2022.

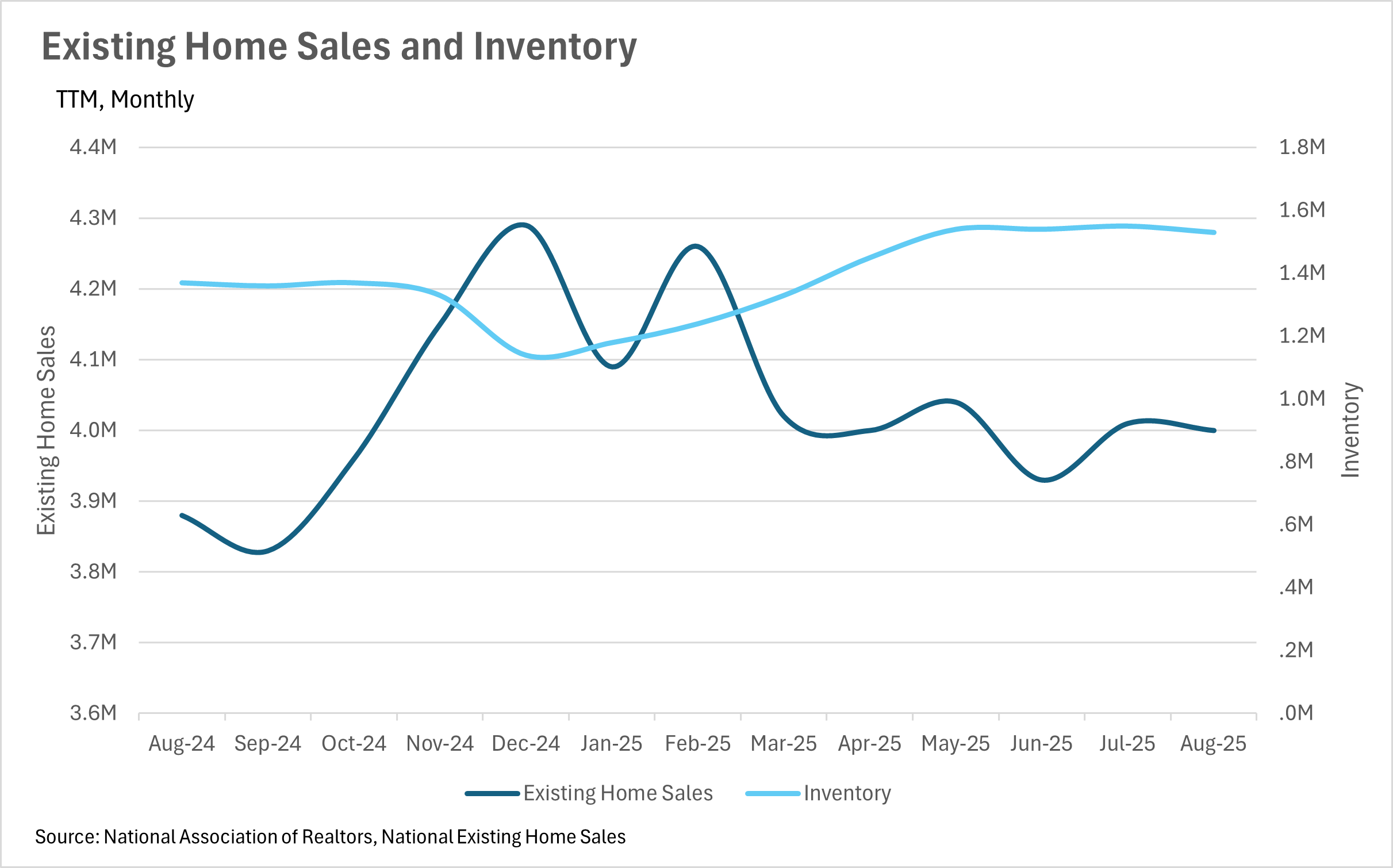

As we mentioned above, the national inventory is quite a bit higher than last year, with 11.68% more homes listed on the market. This really underscores the fact that buyers have decided mainly to throw in the towel and wait for a better chance to purchase a home. When you combine this with the fact that there were 4.88% more new homes hitting the market than this time last year, you have a recipe for growing inventory!

As we move into the seasonally slow months, the market environment that we’re in is setting up for what could be a very interesting 2026. Inventories are still growing (for now), and interest rates are falling, which could put us in a very interesting position when the spring frenzy begins next year. It’ll be important to keep a keen eye on both the market and broader macroeconomic conditions throughout the fall and winter, so that you and your clients are ready for whatever spring has to throw at you.

All of this is just what we’re seeing at a national level, though. To get a better idea of what’s going on in your local market, be sure to check out your local lowdown below:

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

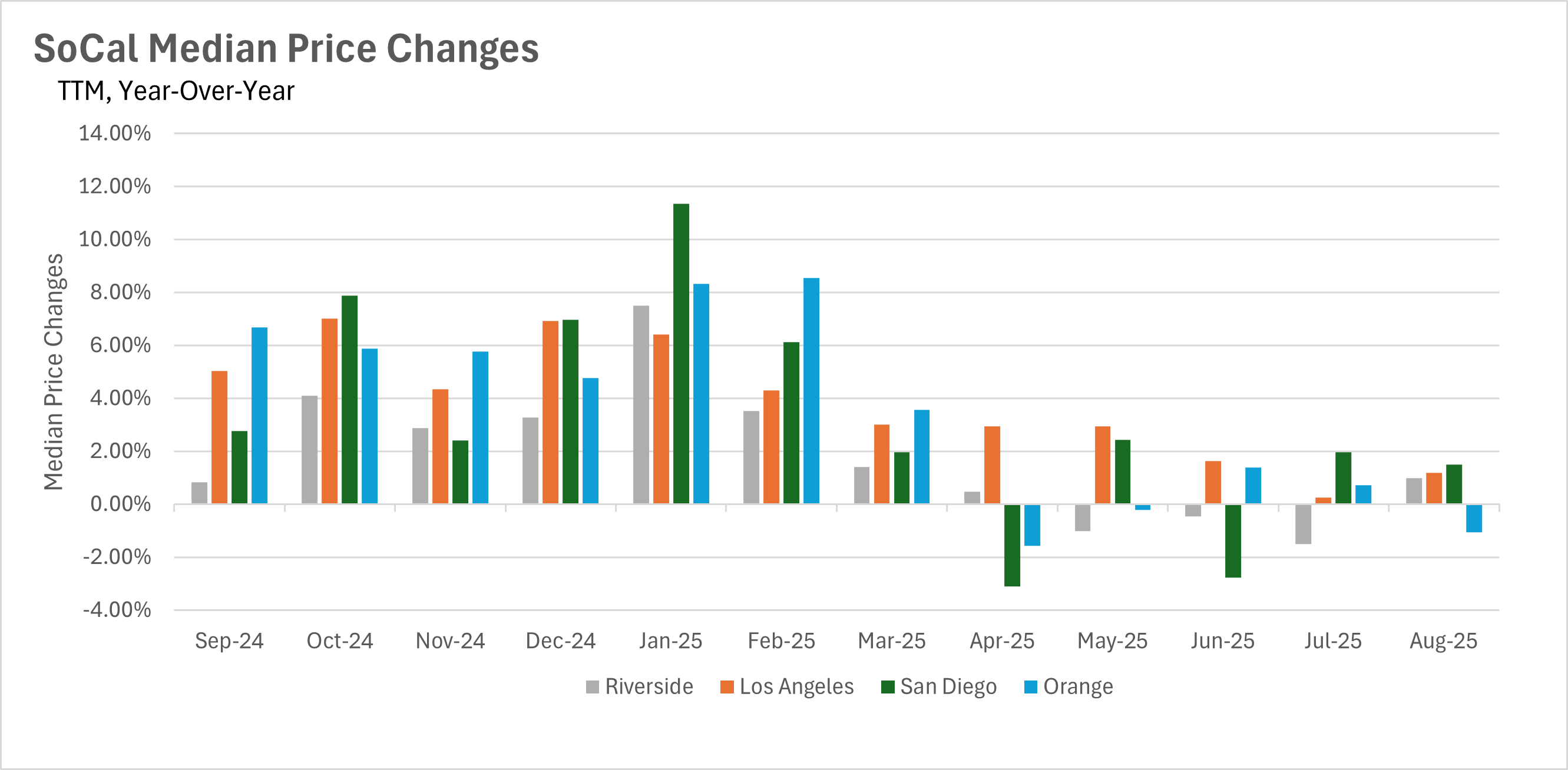

Southern California's real estate markets are displaying increasingly divergent price trends, with some counties showing renewed strength while others experience continued weakness. Los Angeles County has demonstrated the most encouraging turnaround, with August median prices reaching $930,720 and year-over-year growth accelerating to 1.18% from July's near-zero 0.26% rate, suggesting the market may have found solid footing after testing its price floor. San Diego shows modest stability with August prices holding at $1,025,000 and 1.49% annual growth, maintaining value despite earlier summer volatility. In stark contrast, Orange County has returned to negative territory with August prices declining 1.07% year-over-year to $1,385,000, marking the third month of negative growth in 2025. Riverside County shows slight improvement with 0.98% growth to $625,000 in August, breaking a string of negative readings. This divergence reflects varying local supply-demand dynamics, with some markets stabilizing while others continue adjusting to new realities where abundant inventory and extended selling times translate into meaningful price pressures.

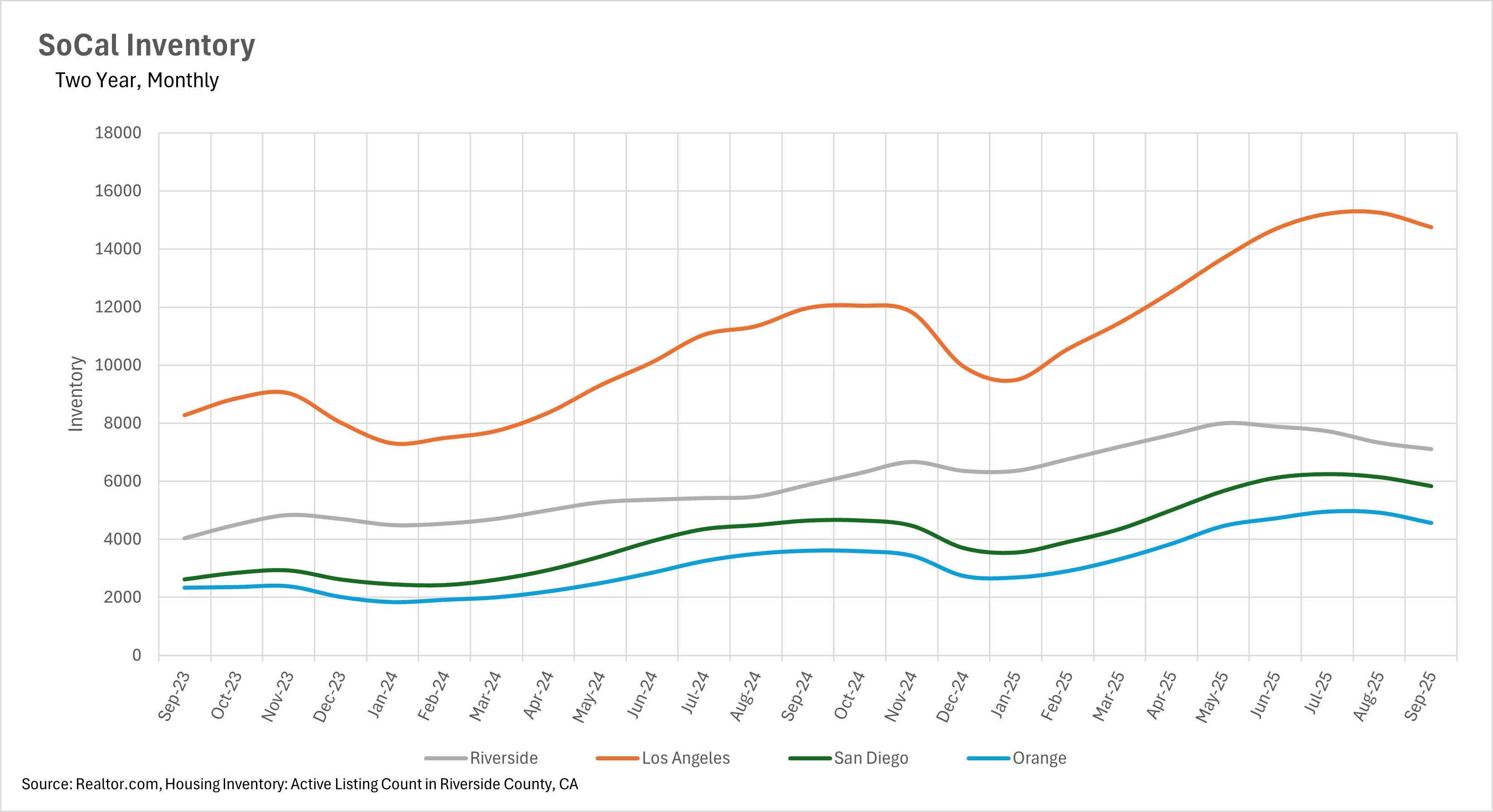

After months of relentless growth, Southern California inventory levels have begun meaningful seasonal retreat across all major counties, suggesting markets may have reached peak supply levels. Orange County shows the most pronounced decline with September inventory dropping 7.24% month-over-month to 4,561 homes, marking the second consecutive monthly decrease. Los Angeles County experienced a 3.28% decline to 14,757 listings in September, the first meaningful decrease since the inventory surge began. San Diego saw inventory fall 5.03% to 5,833 homes, while Riverside dropped 2.02% to 7,105 homes. Despite these monthly declines, year-over-year comparisons remain dramatically elevated, with Riverside up 42.59%, Orange County up 26.59%, San Diego up 25.55%, and Los Angeles up 23.22% compared to last year. This seasonal normalization suggests that typical market patterns are beginning to reassert themselves after the extraordinary inventory buildup throughout spring and summer 2025. The retreat from peak levels indicates either that fewer sellers are entering the market as they recognize current challenges, or that absorption rates have improved as buyers capitalize on the substantial selection available.

The most striking development across Southern California is the continued extension of days on market despite declining inventory levels, demonstrating a fundamental shift in buyer behavior. Riverside County experiences the longest marketing times at 46 days in August—a dramatic 41.38% year-over-year increase and 7.89% monthly increase from July. Orange County homes now spend 32.5 days on market, up 47.73% annually and 16.07% from the previous month, reaching new multi-year highs. Los Angeles properties take 28 days to sell, representing a 33.33% year-over-year increase, while San Diego homes spend 27 days on market, up 58.82% from last year. This deterioration in market timing, even as absolute inventory levels decline, reveals that buyers remain cautious and methodical in their approach despite having slightly fewer options. The trend indicates that buyer behavior has fundamentally changed, with purchasers taking unprecedented time to conduct thorough due diligence, compare multiple properties, and negotiate favorable terms without the pressure of competing offers that characterized previous years' rapid-fire market conditions.

Southern California counties are demonstrating markedly different market balance conditions, with some maintaining equilibrium while others swing decisively toward buyer advantages. Los Angeles County has returned to strong buyer's market territory with 4.3 months of supply in August, representing a substantial 16.22% monthly increase from July's 3.7 months and a 38.71% year-over-year jump. This reversal from July's improvement toward balance suggests that absorption rates have slowed more dramatically than inventory has declined. Riverside maintains strong buyer's market conditions at 4.3 months of supply, though showing some improvement with a 6.98% monthly decrease. Orange County operates in buyer's market territory at 3.2 months, showing slight moderation but maintaining 18.52% year-over-year growth in supply levels. San Diego demonstrates the most balanced conditions at 3.3 months of supply, successfully maintaining equilibrium after transitioning from the sellers' market that dominated recent years. This regional variation reflects different local dynamics in supply growth and absorption rates, with larger, more diverse markets like Los Angeles showing more volatility while San Diego has achieved more stable balanced conditions. For all markets, the trend toward buyer advantages represents a complete reversal from the seller-dominated landscape of 2023 and early 2024.

Stay up to date on the latest real estate trends.

March 2026

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

You’ve got questions and we can’t wait to answer them.