Market Update Los Angeles

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

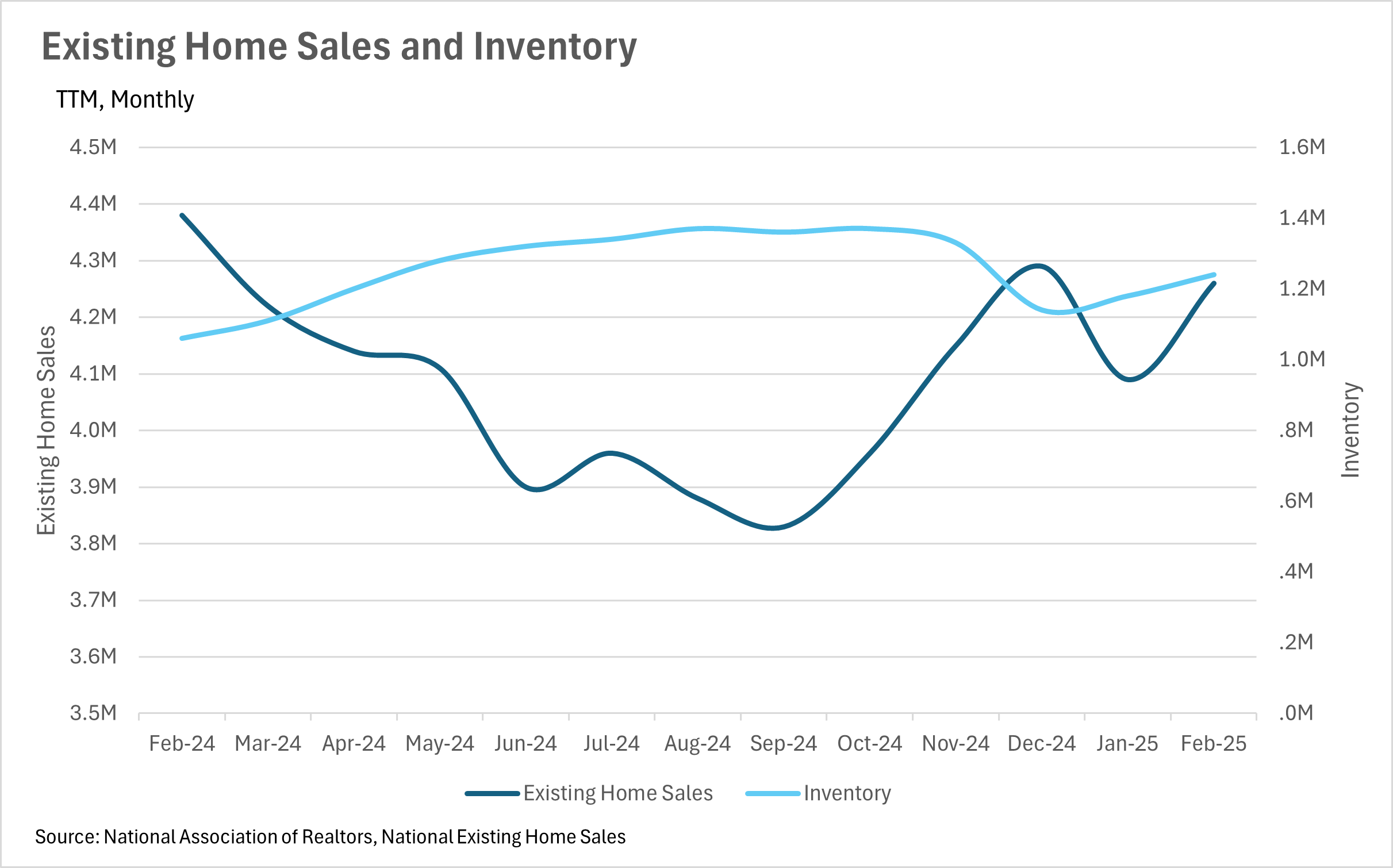

Although we are just about to exit the slow season for real estate sales, things are looking great overall. We saw a slight decrease in the number of sales on a year-over-year basis in February, with there being 4,260,000 sales in February 2025, compared to 4,380,000 in February 2024. However, on the flip side, we saw considerably more inventory added this year, with 1,240,000 homes on the market in February of this year, compared to 1,060,000 homes on the market around this time last year.

This means that all over the country, buyers have many more options than in recent years, which may lead to listings sitting on the market for a bit longer than what we’ve seen over the past couple of years. When you couple this with the fact that there are more new listings being added to the market, with just over 10% more listings added in March of 2025, compared to March of 2024, we might see some power start moving away from sellers to the buyers.

Additionally, this uptick in new listings might be an indication that sellers are starting to accept the fact that considerably lower mortgage rates aren’t coming anytime soon. Although many were holding out hope over the course of the past couple of years, the Fed has made it very clear that they’re not looking to drop rates by a considerable margin anytime soon. This, of course, means that prospective sellers have an important choice to make - whether they should sell, or continue holding out. From the data that we’re seeing, it seems that many sellers are beginning to choose the former option!

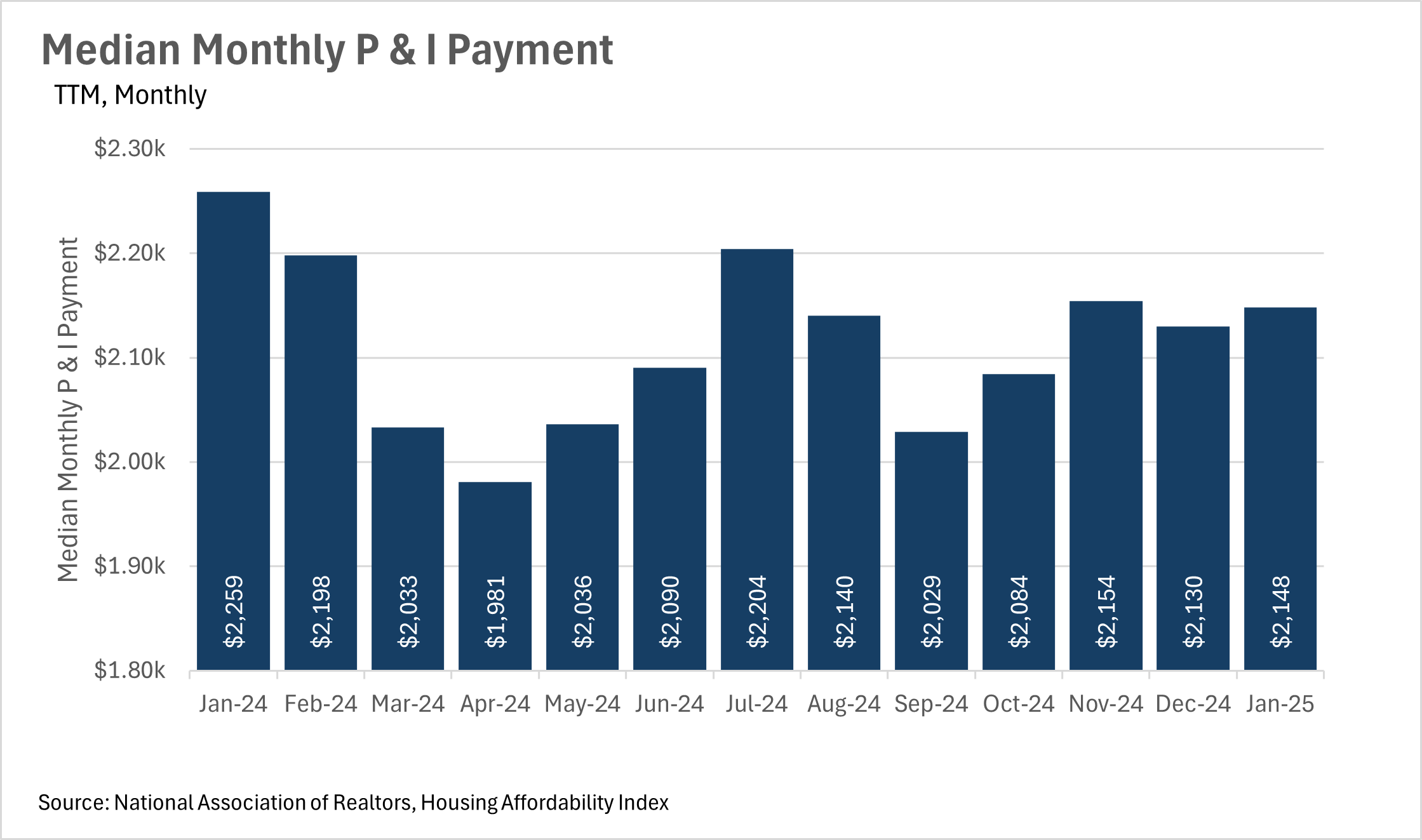

When turning to affordability, we saw a rather interesting phenomenon - median monthly P&I payments decreased by nearly 5%, all while interest rates and median sale prices increased by just under 4%. This likely means that there was a considerable cohort of homeowners out there that locked in rates toward the end of 2023 when rates were at a local high, and recently refinanced when rates came down a bit. The median consumer having an additional $100 in their pocket each and every month is a great thing for the economy, especially when we face economic uncertainty, tariffs, and ever-changing geopolitics!

Lastly, it’s important to note that it’s business as usual in terms of the Federal Reserve. In their recent FOMC meeting, they decided to hold the federal funds rate firmly where it has been over the past couple of months. Fed officials also indicated that they are not in a rush to lower rates by a considerable margin anytime soon. However, that could always change, as we’re living in an incredibly dynamic era right now! Additionally, the Fed is continuing to offload mortgage-backed securities at a steady pace!

Ultimately though, this is just what we’re seeing at a national level. As we all know, real estate is an incredibly localized industry, so knowing what’s going on in your own market is pivotal. Below is our local lowdown, that outlines everything you need to know about what’s happening around you in your neighborhood and surrounding areas!

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

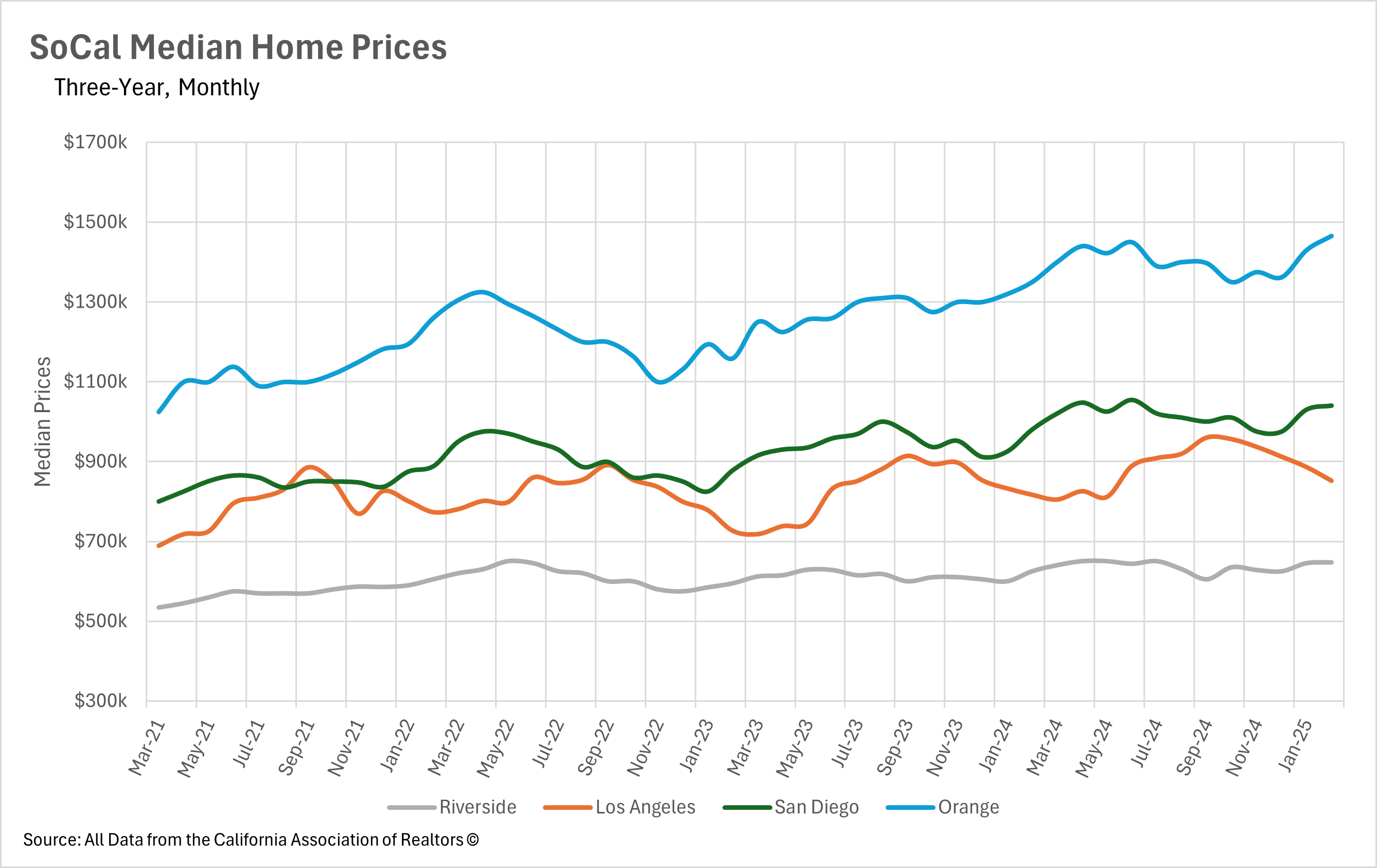

Southern California has maintained strong price appreciation across all major counties despite significant changes in market conditions. In February 2025, Orange County led the region with an impressive 8.56% year-over-year increase in median sale price to $1,465,500, followed by San Diego County with 6.12% growth to $1,040,000. Los Angeles County showed more moderate but still healthy growth at 4.29% to $852,190, while Riverside County experienced the most modest appreciation at 3.51%. This continued price growth across all markets demonstrates the enduring demand for Southern California real estate, even as inventory levels rise and the market balance shifts toward buyers.

One of the most dramatic shifts in the Southern California real estate landscape has been the substantial increase in available inventory across all counties. San Diego County led the region with a 67% year-over-year increase in February 2025, followed closely by Orange County at 65.93%. Los Angeles County saw a 48.10% jump in active listings, while Riverside County experienced a 41.58% increase. This flood of new inventory has fundamentally altered market dynamics throughout the region, giving buyers significantly more options and stronger negotiating positions than they've had in several years. The consistent month-over-month increases observed across all counties suggest this trend may continue as we move into the traditionally busy spring selling season.

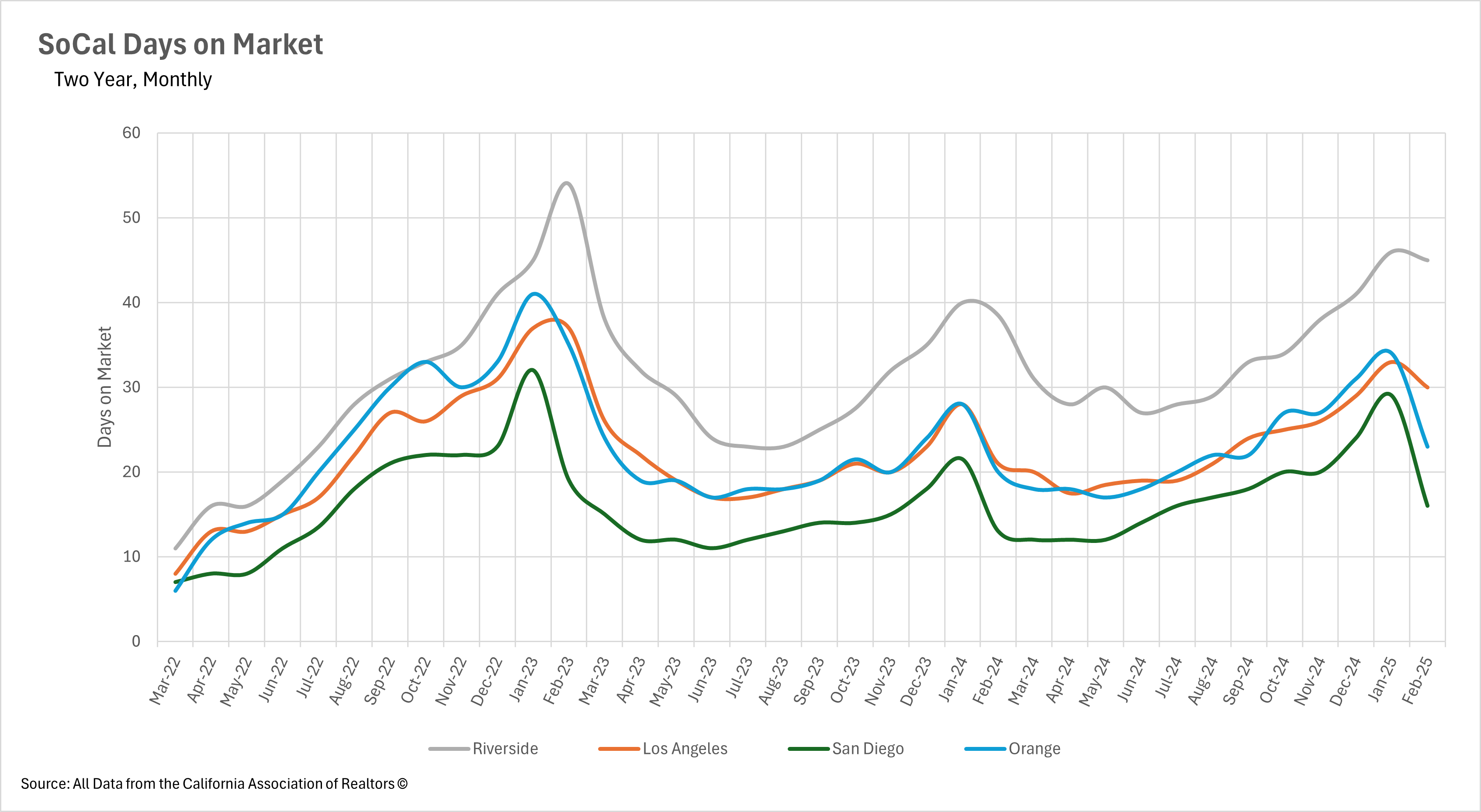

As inventory has accumulated throughout Southern California, listings are predictably spending more time on the market before selling. Los Angeles County has seen the most dramatic change, with the median home now sitting on the market for 30 days before going under contract—a 42.86% increase compared to February 2024. Riverside homes now take a median of 45 days to sell (up 17.14%), while Orange County listings remain on the market for 23 days (up 15%). San Diego County, despite its substantial inventory increase, has shown the most resilience in this metric, with homes taking a median of just 16 days to sell, though this still represents a 23.08% increase from the previous year. These extended marketing periods reflect a fundamental shift in buyer behavior, with purchasers taking more time to evaluate their options in a less competitive environment.

Perhaps the most significant change in the Southern California real estate landscape is the shift in market balance from strongly favoring sellers to now giving buyers the advantage in most counties. When measuring Months of Supply Inventory (MSI)—with three months historically representing a balanced California market—we see that all SoCal counties have moved toward or beyond this threshold. Riverside leads with 4.9 months of inventory, followed by Los Angeles at 4.1 months, both firmly in buyer's market territory. San Diego and Orange counties are both at 3.4 months, just crossing into buyer's market range. This represents a dramatic change from early 2024, when all counties had MSI readings between 2.0 and 2.7 months, indicating strong seller's markets. `This fundamental shift gives buyers significant negotiating leverage for the first time in several years, while requiring sellers to adjust their expectations and strategies to succeed in this evolving market landscape.

Stay up to date on the latest real estate trends.

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

August 2025

You’ve got questions and we can’t wait to answer them.