Market Update Los Angeles

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

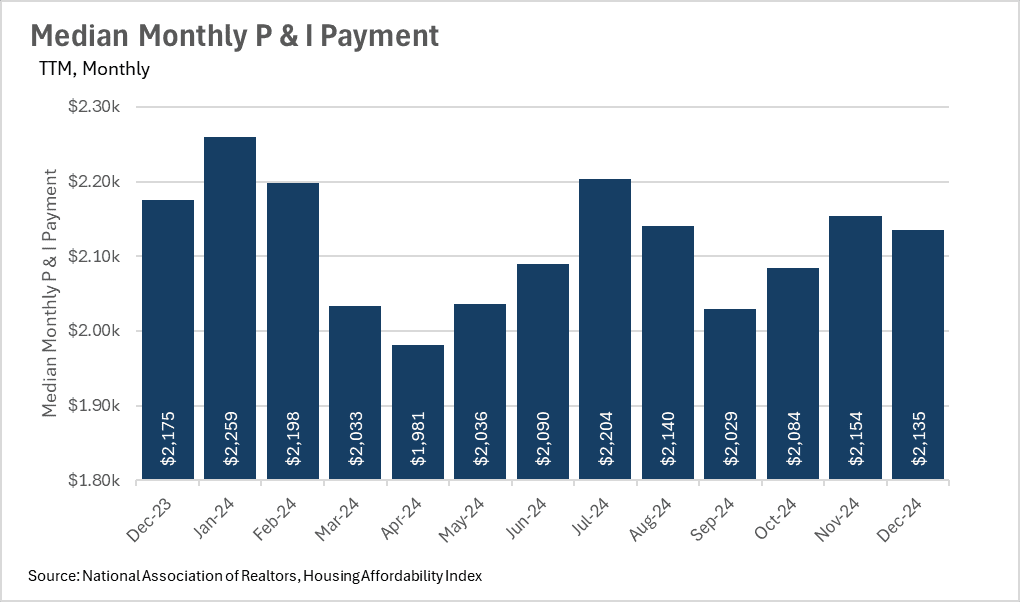

One of the headline issues in the real estate industry over the past few years has been, of course, the affordability (or rather the unaffordability) of homes. Unfortunately for new buyers, and more specifically first time home-buyers, this issue looks like it will persist throughout 2025. Mortgage rates remain comparatively high, and home prices largely have not given back their pandemic-era gains.

This has, of course, made the dreams of homeownership difficult to achieve for countless people around the country. With the median monthly principal and interest payment exceeding $2,100 per month on a nationwide level, people are struggling to afford the purchase of a new home!

Fortunately for the market, there are plenty of new homes hitting the market though. While there are countless people sitting on the sidelines, waiting for lower interest rates to sell their current home and buy a new one, some of these holdouts are giving up and listing their homes. The writing seems to be on the wall, meaning more and more people are giving up on the thought that we will see lower interest rates in the short term, causing them to list their homes.

This has resulted in a pleasant jump in new home listings, despite us being at the tail end of the slow season. In the month of february, we saw more than 353,000 homes hit the market nationwide. This represents a 4.21% increase on a year-over-year basis, and an 8.15% increase on a month-over-month basis!

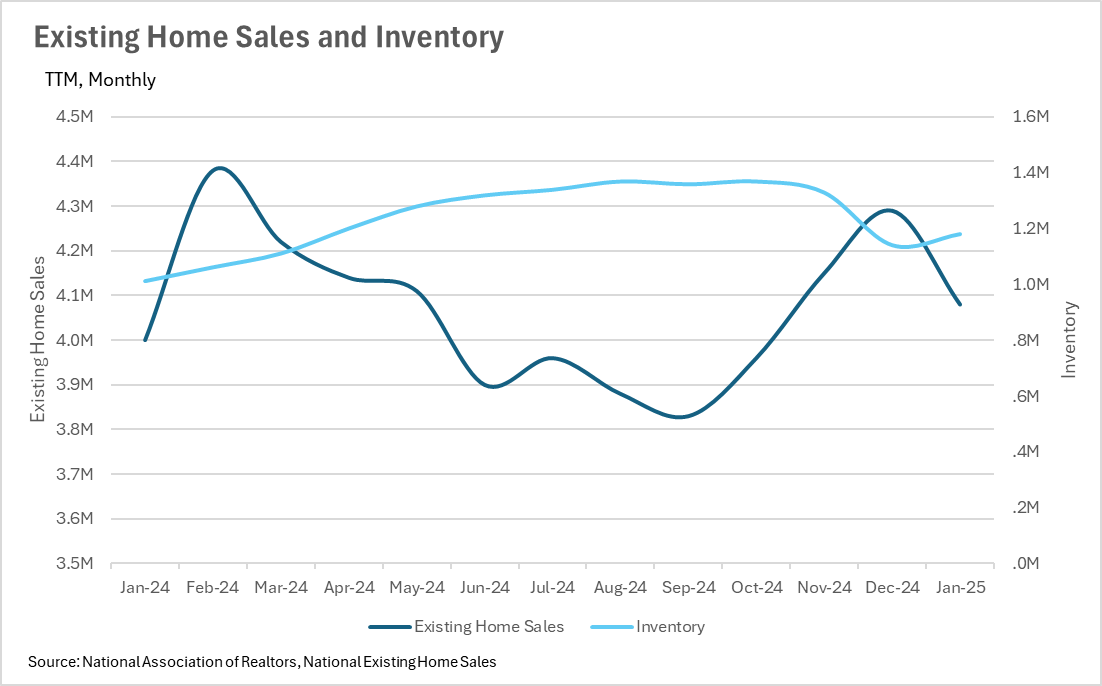

Since we are seeing new inventory hit the market and a steady level of demand, this is causing inventories to build, which is a great sign for those looking to enter the market! In the month of January, there were 1,180,000 homes listed on the market, representing a 16.83% increase on a year-over-year basis and a 3.51% increase on a month-over-month basis. At the same time, we’re seeing demand stagnate a bit, with 4,080,000 homes sold in January, representing a 2% increase when compared to last year and a 4.9% decrease when compared to last month!

Although a top-tier property will likely end up in a bidding war, no matter if it’s in Kansas City or Calabasas, this increase in inventory could mean that there are some deals to be had on listings that sit on the market for a few weeks.

While there are areas that deviate from the national trends, this is generally what's happening nationwide. Below, you'll find a local lowdown that provides you with the in-depth coverage of your area that you need. We will continue to monitor the housing market and overall economy to help guide you in buying or selling your home.

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

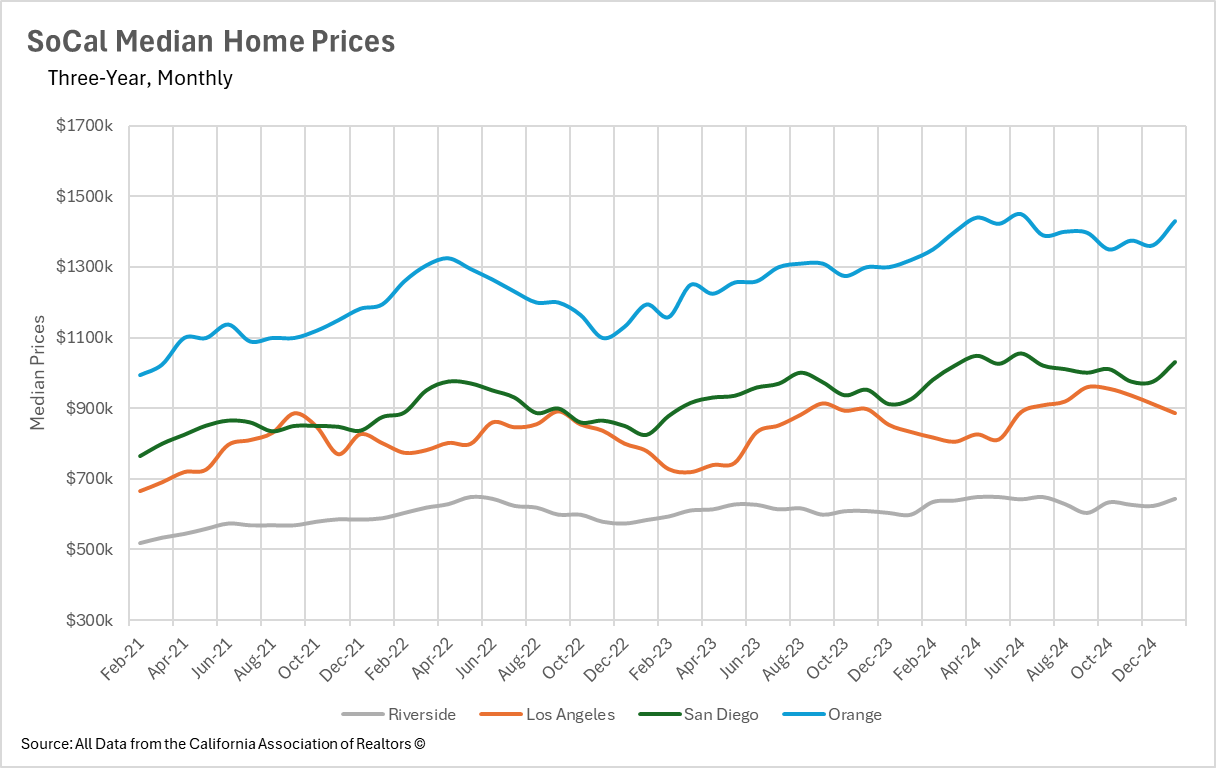

Despite economic headwinds and higher mortgage rates, Southern California's housing market continues to demonstrate remarkable price resilience. San Diego leads the region with an impressive 11.35% year-over-year increase, bringing median home prices to $1,030,000 in January 2025. Orange County follows with a solid 8.33% growth and the highest median price point at $1,430,000. Riverside and Los Angeles show healthy appreciation at 7.50% and 6.41%, respectively. This consistent price strength across all markets reflects Southern California's enduring desirability, even as other market indicators suggest a significant shift in conditions.

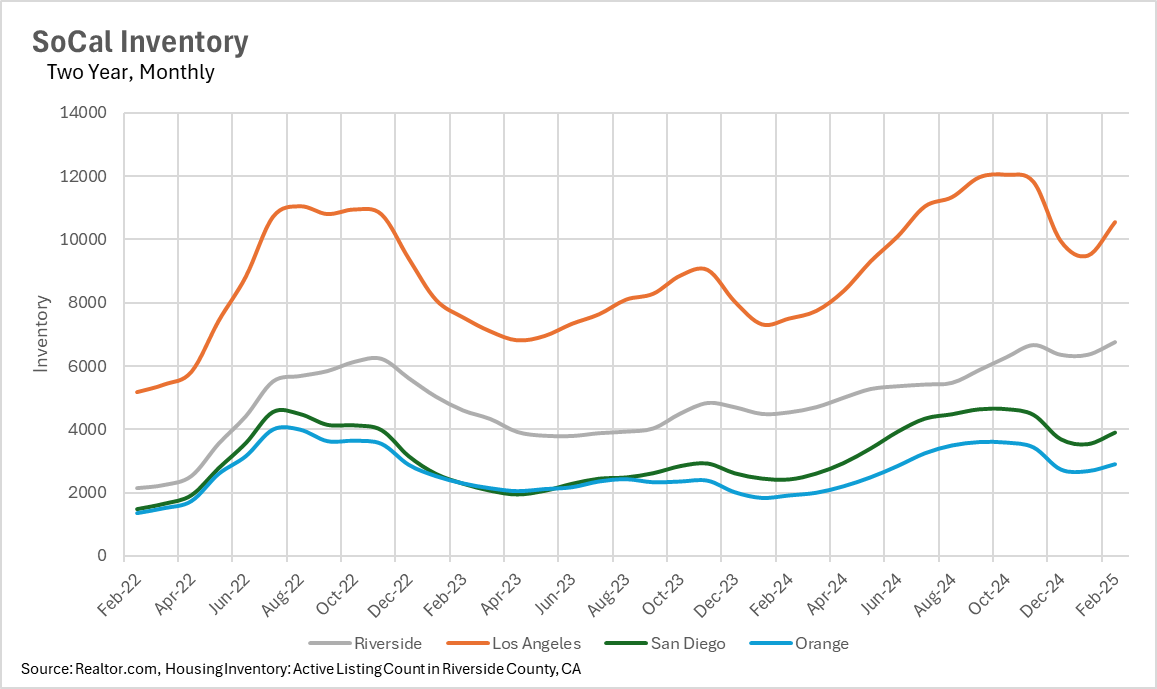

A dramatic influx of available homes is reshaping Southern California's real estate landscape. San Diego experienced the most substantial inventory growth at 61.30% year-over-year, followed by Orange County at 51.88%, Los Angeles at 40.79%, and Riverside at 35.18%. This region-wide surge is particularly noteworthy given the historically tight inventory constraints of recent years. With active listings increasing significantly in all areas, buyers now have substantially more options than at any point in the recent past. In Los Angeles alone, inventory jumped 11.18% from January to February 2025, indicating that this trend is accelerating rather than stabilizing.

As inventory expands, the urgency that characterized recent seller's markets has dissipated. Homes across Southern California are taking significantly longer to sell, with San Diego seeing the most dramatic increase in days on the market at 34.88% year-over-year. Los Angeles properties now spend an average of 33 days on the market (up 17.86%), while Orange County listings take 34 days (up 21.43%). Riverside properties remain on the market the longest at 46 days, representing an 18.75% increase from the previous year. These extended timelines reflect buyers' newfound ability to exercise patience, compare multiple properties, and negotiate more aggressively with sellers.

The most significant indicator of Southern California's market transformation can be seen in the Months of Supply Inventory (MSI) metrics. With California historically averaging around three months of MSI for a balanced market, all major Southern California regions now exceed this threshold. Riverside leads with 5.2 months of inventory, followed by Los Angeles at 4 months, San Diego at 3.4 months, and Orange County just above the balanced threshold at 3.2 months. Los Angeles experienced a particularly dramatic shift, with a 48.15% increase in MSI from December to January. This consistent region-wide trend marks a decisive end to the seller's market that has dominated Southern California real estate in recent years, giving buyers significant negotiating leverage for the first time in this market cycle.

Stay up to date on the latest real estate trends.

March 2026

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

You’ve got questions and we can’t wait to answer them.