Market Update Los Angeles

Note: You can find the charts & graphs for the Big Story at the end of the following section.

*National Association of REALTORS® data is released two months behind, so we estimate the most recent month’s data when possible and appropriate.

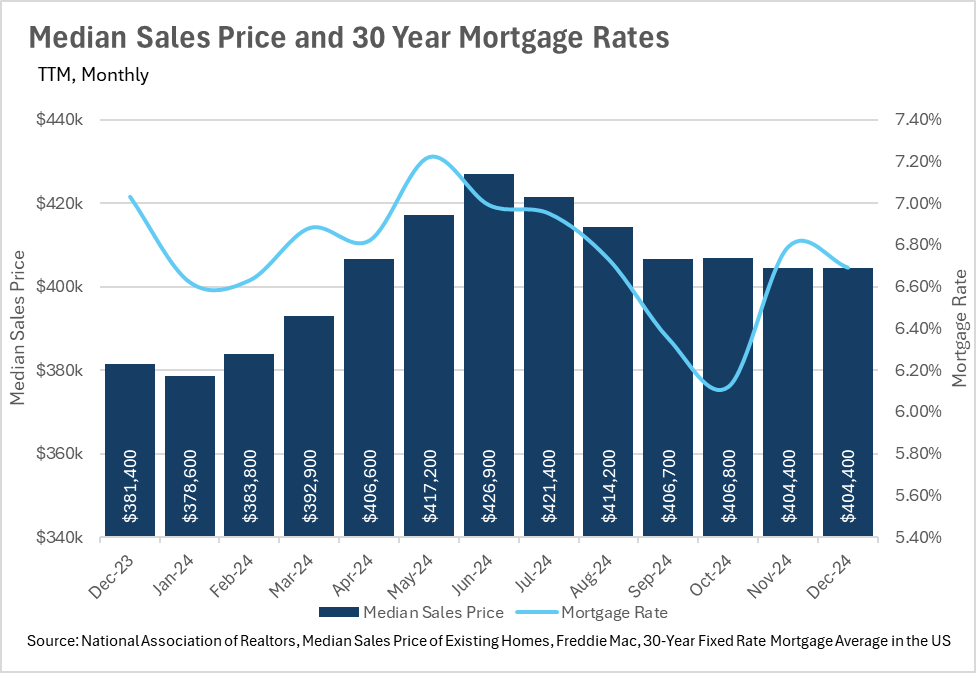

One very interesting phenomenon that we’ve seen play out over the past few months is that interest rates have largely returned to the levels that we saw prior to the Fed’s first rate cut in September. Unfortunately this is not what the market at large was expecting to see, since mortgage rates typically move in tandem with the Federal Funds rate. However, this suggests that the lending market expects the rate cuts that we have seen recently to be short lived, meaning that the lending market is expecting the Fed to begin increasing rates again within the coming years. This could be due to a variety of reasons, but inflation is the most likely culprit for rate hikes, as it has remained rather stubborn since it first became an issue in 2022.

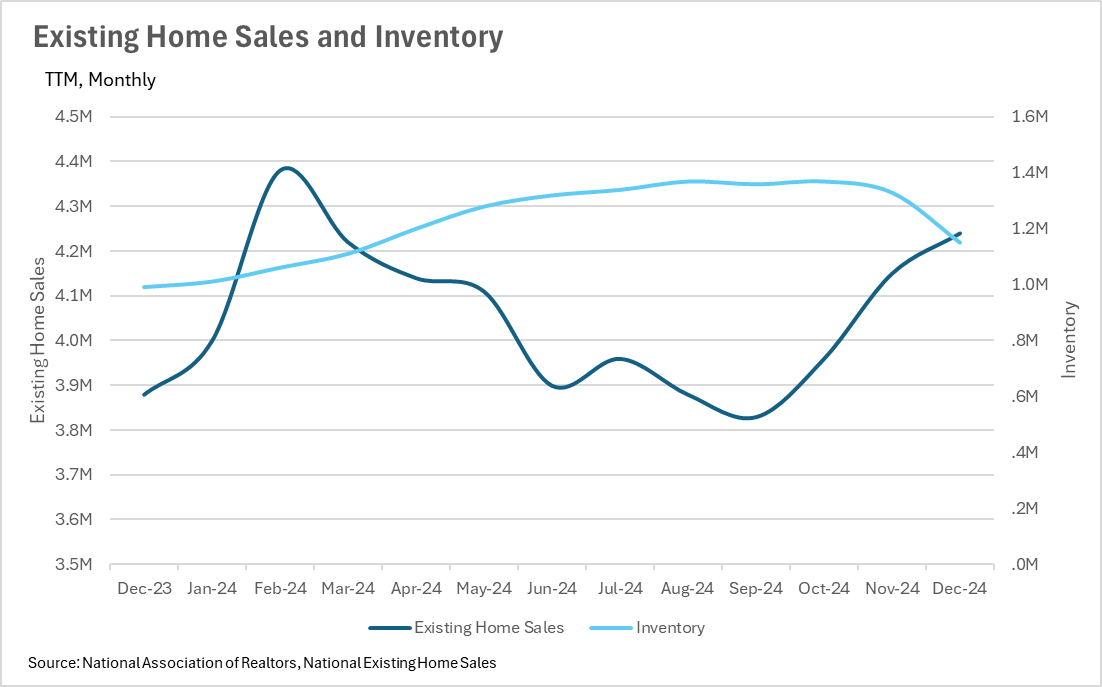

As we all know, inventory levels have been an issue Post-COVID, across the entire country, with many areas not having nearly enough inventory to support buying demand. This, in turn, helped to push up the values of homes nationwide.

It’s important to note though, that we’re beginning to see inventory growth outstrip existing home sale growth, as in December, inventory grew by 16.16% on a year-over-year basis, whereas existing home sales grew by 9.28% year-over-year.

Many buyers still have the mortgage rates that they saw in 2021 and 2022 at the top of their mind, making it difficult for them to justify locking in a mortgage in the 6%-7% ranges that we’ve been seeing over the past couple of years. Despite many buyers sitting on the sidelines, and waiting for lower rates, we’re still seeing the median sale price of homes increase.

In both the months of November and December, the median sale price of a home in the United States was $404,400. This represents an increase in value of 6.03%, when compared to the December 2023 median sale price of $381,400. This is slightly concerning, given that the growth in median sales price continues to outstrip the growth in inflation, with December’s year-over-year CPI figures coming in at 2.9%.

As many of us know, in addition to the Federal Funds Rate, the Fed also has control over its own balance sheet. Throughout the COVID crisis, the Fed ramped up its purchase of mortgage backed securities at a rate we haven’t seen since the Great Financial Crisis. However, the Fed has since been unwinding its holdings of MBS’s at a steady rate, since late 2022, which it continues to this day.

Although it’s great to know what’s happening at a national level, real estate is an incredibly localized industry. There are areas throughout the country that are doing considerably better or worse than the nation at large. To ensure you’re informed on the happenings at both a national level and a local level, we’ve included our local lowdown below. In our local lowdown, you’ll find the in-depth coverage you need to stay in tune with your area. As always, we’ll be monitoring the housing market and the economy from both a macro and micro level, and report back to ensure you’ve got the data you need to make the best decisions possible!

Note: You can find the charts/graphs for the Local Lowdown at the end of this section.

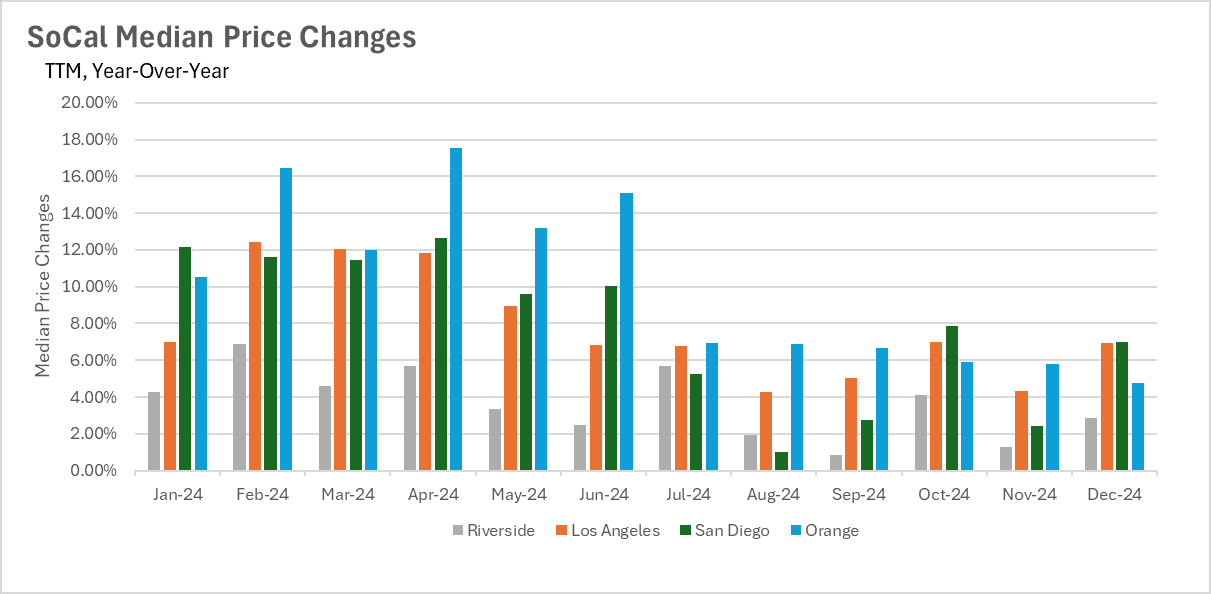

Southern California has continued to see price appreciation, though the rate of growth varies by region. San Diego experienced a significant rebound in the final quarter of 2024, ending the year with a 6.97% year-over-year increase, bringing the median sale price to $975,000. Similarly, Los Angeles saw a 6.92% increase, with a median price of $912,370 in December. On the other hand, Orange County's price growth has begun to slow as it faces tougher year-over-year comparisons. With inventory flooding the market, future price growth remains uncertain. Meanwhile, Riverside has also experienced steady price appreciation, with median sale prices increasing every month in 2024. The latest data from December shows a 2.85% increase in median sale prices.

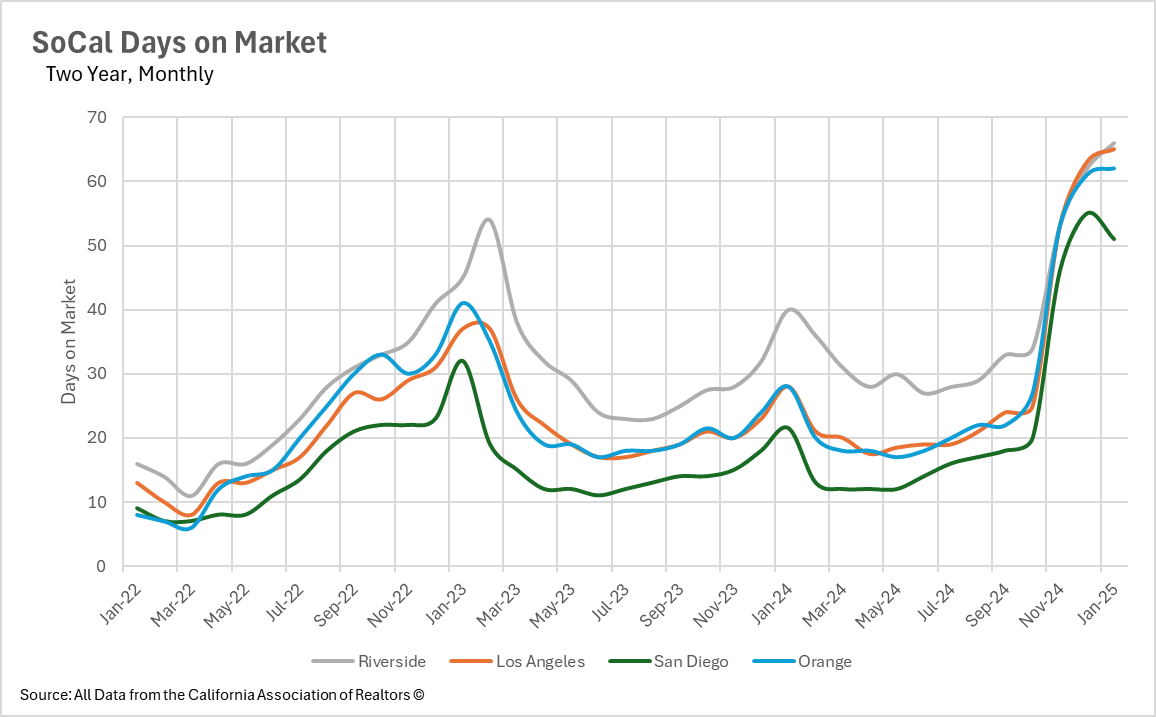

Inventory levels have surged across Southern California, providing buyers with more options and leading to more cautious decision-making. San Diego saw a 44.54% year-over-year increase in January, while Orange County’s inventory jumped 46.42% in the same period. Los Angeles experienced a nearly 30% increase, and Riverside saw a 37.82% rise. While these numbers indicate a flood of new listings, many areas still fall short of a truly balanced market. This increase in inventory has also contributed to longer listing periods as buyers take their time exploring options.

With an influx of listings, homes across Southern California are sitting on the market longer than before. In Los Angeles, the median days on market reached 65 days, a 132.14% increase year-over-year. San Diego followed with a median of 51 days, marking a 137.21% jump. Orange County listings sat for an average of 62 days in January, compared to 53 days in November. Riverside saw a 23.64% year-over-year increase, with the average home now taking 66 days to sell. As listings stay on the market longer, the balance of power between buyers and sellers is shifting in some areas.

Despite rising inventory and longer listing times, market conditions vary across Southern California. Los Angeles has flipped to a sellers’ market with only 2.7 months of supply, while Orange County remains strongly in favor of sellers with just 2.1 months of inventory. San Diego is also a sellers’ market, with 2.3 months of supply available. Meanwhile, Riverside stands apart as a buyers’ market, with 3.6 months of supply on the market. As conditions evolve, these classifications may shift in response to new economic and housing trends.

Southern California’s real estate market is in transition. While home prices continue to rise, the pace of growth is slowing in some areas. Increased inventory has given buyers more leverage, which has led to longer listing times. The shifting market dynamics indicate that areas like Riverside are tilting in favor of buyers, while others, such as Los Angeles and Orange County, remain seller-friendly. As we move further into 2025, factors such as interest rates, economic conditions, and buyer sentiment will determine the trajectory of the market. One thing remains clear—buyers now have more options than they have had in quite some time.

Stay up to date on the latest real estate trends.

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

August 2025

Market and Rebuild Update by Anthony Marguleas

July 2025

You’ve got questions and we can’t wait to answer them.