Local Lowdown

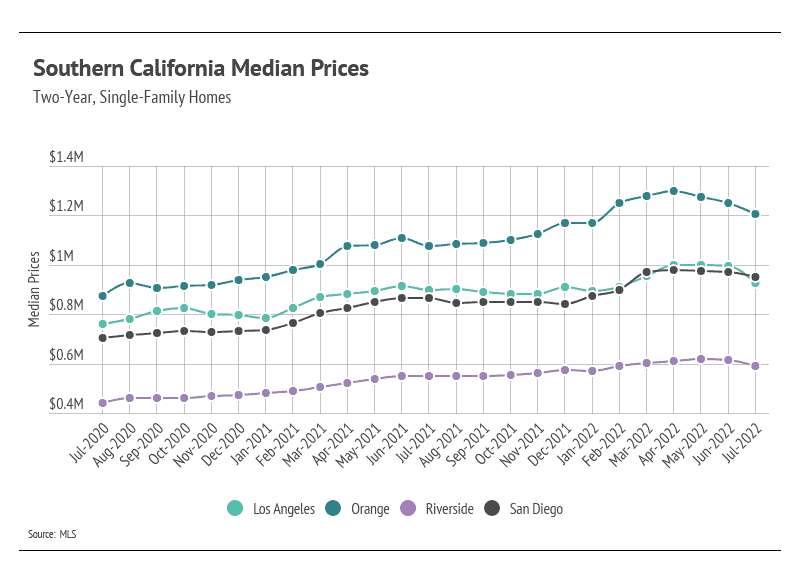

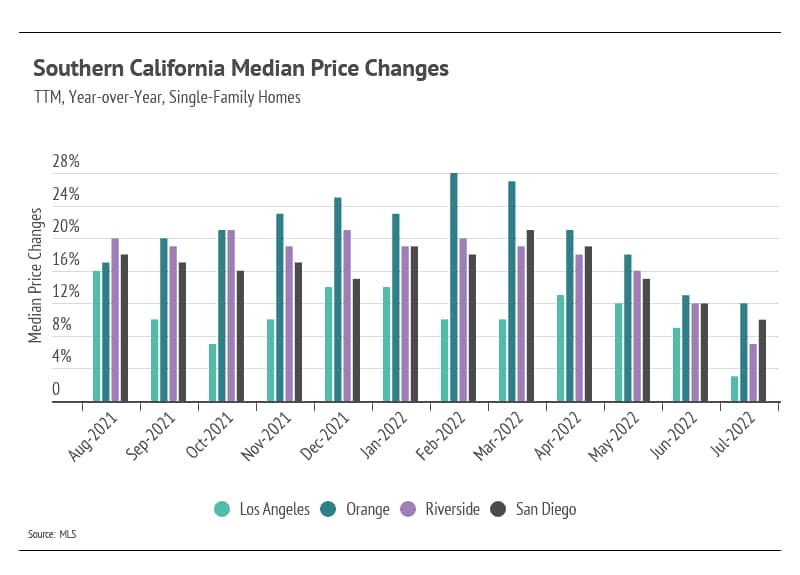

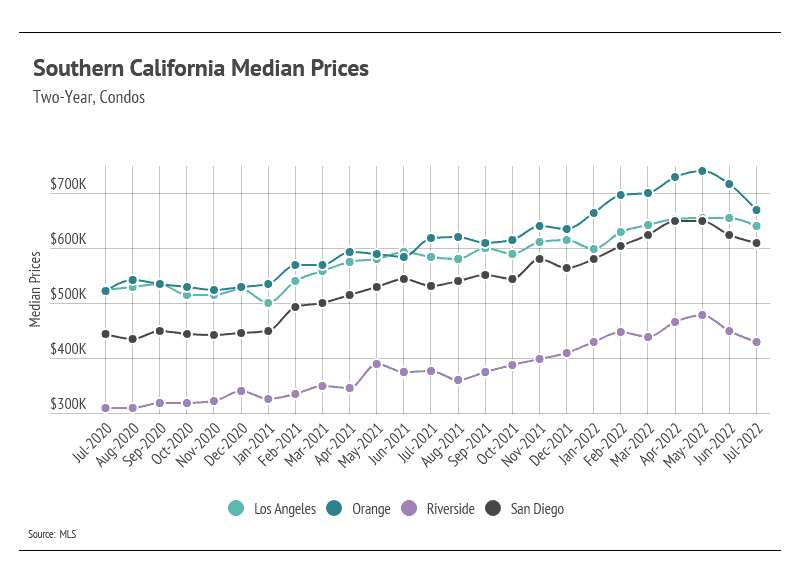

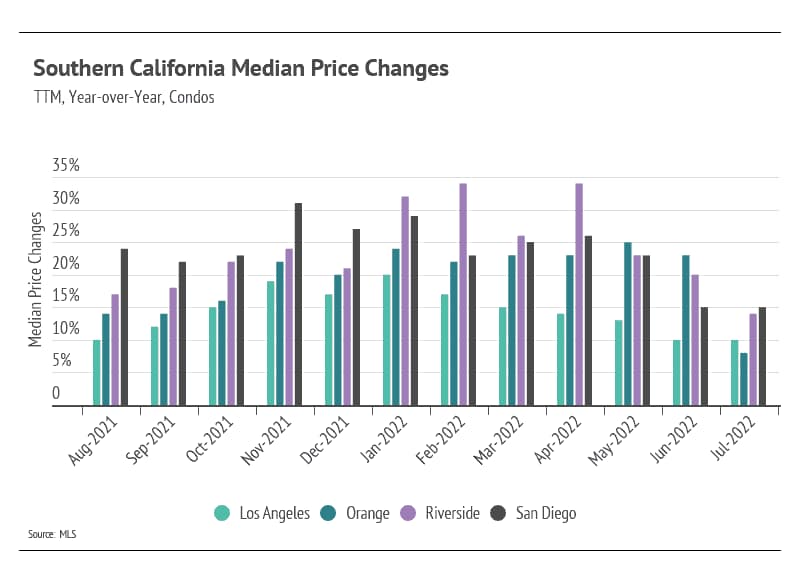

mentioned in the Big Story, prices tend to stagnate in the summer and fall months when inventory is at its highest, so we aren’t ringing the alarm bells quite yet. Homes over the past five years have become less affordable, yet demand boomed. With 30-year mortgage rates potentially settling around 5%, fewer potential buyers will participate in the market than they did last year when mortgage rates were at all-time lows.

Supply is still historically low, which will protect prices from experiencing a major downturn. Prices will likely follow a similar trend as last year, holding relatively steady through the summer and fall months. If you’re following home prices closely, as we tend to do, you don’t need to worry about losing equity in your home, or softening demand, or even an official recession — so long as it doesn’t affect your job. The housing market remains incredibly strong in Southern California.

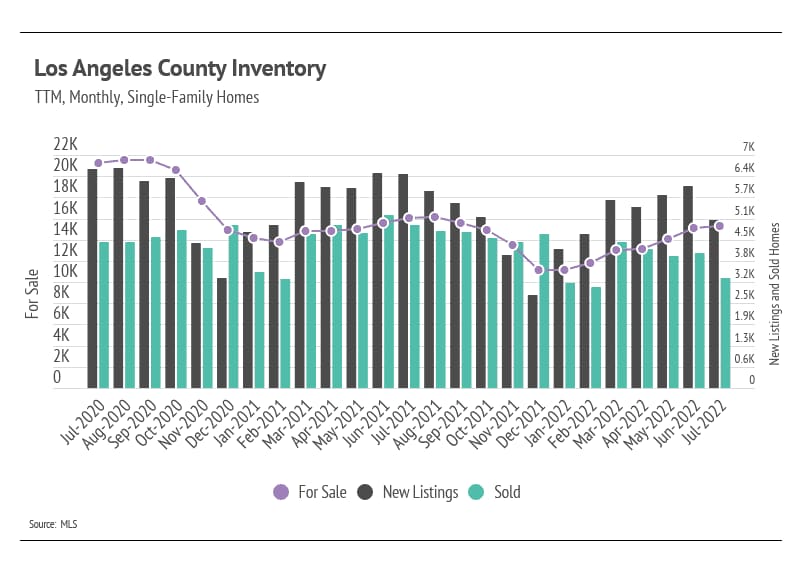

Southern California’s housing inventory continued to rise in July, following historical seasonal trends. Inventory tends to peak in July, which appears to be the case this year. The number of homes for sale has trended lower over the past three years and settled at historically low levels. There were over 13,000 fewer homes on the market in July 2022 than in July 2020. Although 2022 has had one of the lowest inventories on record, we were pleased to see that inventory has increased every month so far. With the substantial drop in sales and new listings, down 20% and 16%, respectively, from June to July 2022, the peak inventory levels for 2022 will undoubtedly be the lowest on record.

The decline in sales, despite rising inventory, indicates that demand is softening. We aren’t saying that demand is low, but it’s trending closer to balanced between buyers and sellers than we’ve seen in years.

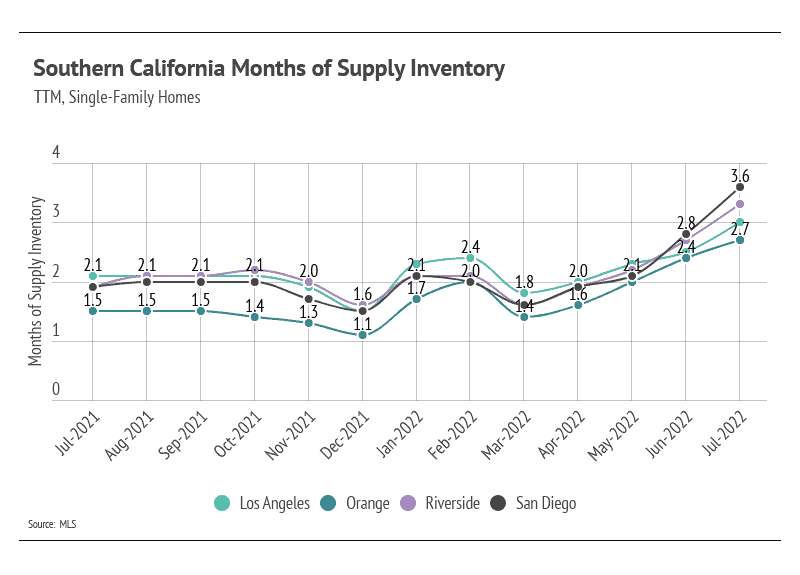

Months of Supply Inventory (MSI) quantifies the supply/demand relationship by measuring how many months it would take for all current homes listed on the market to sell at the current rate of sales. The long-term average MSI is around three months in California, which indicates a balanced market. An MSI lower than three indicates that there are more buyers than sellers on the market (meaning it’s a sellers’ market), while a higher MSI indicates there are more sellers than buyers (meaning it’s a buyers’ market). Notably, single-family home MSI has climbed significantly over the past four months, reaching three months or more for Los Angeles, Riverside, and San Diego for the first time since May 2020, which was an anomalous month due to the early days of the pandemic. One data point does not make a trend, but we are watching closely.

Stay up to date on the latest real estate trends.

March 2026

February 2026

January 2026

Trusted Experts in the Palisades, Santa Monica, and Brentwood Real Estate Markets

How Sellers In Pacific Palisades, Santa Monica And Brentwood Get It Right

December 2025

November 2025

October 2025

September 2025

You’ve got questions and we can’t wait to answer them.